Before the COVID-19 pandemic devastated hotel performance trends across all property types, soft brands were continuing to deliver hardline results at a pace that exceeded that of their traditionally branded counterparts.

This article explores soft brand performance pre-pandemic. STR will continue to monitor performance of this subsector, as well as that of all hotel types, as the industry charts a path toward recovery in the coming months and years.

What is a soft-branded hotel?

By definition, a soft-branded hotel has a franchise affiliation but maintains its unique identity instead of relying upon the chain’s standardization. A soft-branded hotel can benefit from the resources provided by chains, including their global distribution systems and central reservation systems. Examples of soft-branded hotels are Autograph Collection by Marriott, Ascend Collection by Choice, and Curio Collection by Hilton.

How many soft-branded hotels are in the U.S.?

As of May 2020, there were 568 soft-branded hotel properties comprising nearly 68,000 rooms in the United States. More than 90 percent of those rooms are affiliated with just five hotel companies: Marriott International, Choice Hotels International, Hilton Worldwide, Best Western Hotels & Resorts, and Hyatt Hotels Corporation.

Are soft-branded hotels becoming more popular?

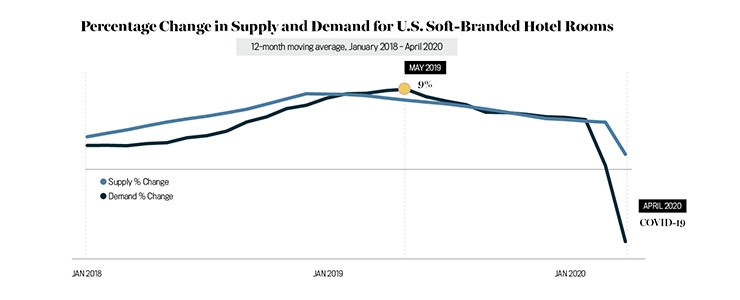

In a word, yes. Soft-branded hotels have shown impressive demand growth in the past two years, peaking at 9 percent in May 2019. By comparison, the average demand growth of all branded hotels (including both soft brands and more traditional brands) during the same period was only 2.3 percent.

Soft brands’ popularity among travelers has not gone unnoticed by investors. There are roughly 24,000 soft-branded hotel rooms in the active pipeline, which is about 35 percent of the current soft-branded room supply. The supply growth in soft-branded rooms was 5.7 percent in 2019, or double the average growth rate of all branded U.S. hotels (2.4 percent) that year.

Although demand soared, such rapid supply growth created an unfavorable imbalance between demand and supply that resulted in a near 0 percent year-over-year change in occupancy.

Do soft brands attract more transient or group guests?

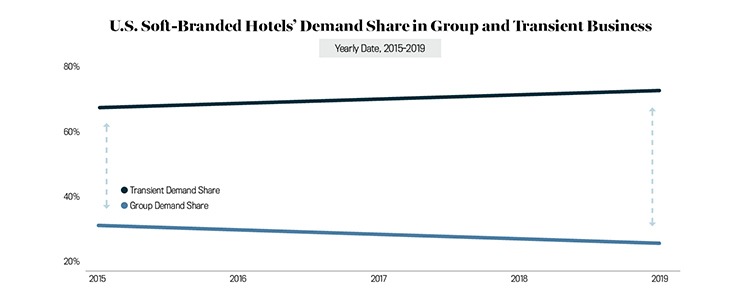

While strong overall demand patterns suggest soft brands are liked by transient and group guests alike, the sectors’ more independent, boutique-style feel have made them more popular with transient guests seeking unique, localized hotel stays.

A closer look at the past five years reveals the demand share for soft-branded hotels has shifted toward transient travelers.

Are soft-branded hotels delivering promising results?

Although 5.7 percent of new rooms were added to the soft-branded hotel landscape in 2019, soft-branded hotels experienced a 2.4 percent increase in revenue per available room, supported mainly by ADR (2.2 percent). By contrast, all U.S. branded hotels observed only 0.3 percent growth in RevPAR.

Overall, soft-branded hotels are trending in the United States, as evidenced by both strong demand among travelers and supply growth among investors in the past two years. As a result, their RevPAR outperformed the U.S. branded hotel average in 2019. In the future, more soft-branded hotels will be added, because rooms in the pipeline account for 35 percent of today’s current supply.

As COVID-19 continues to cause severe drops in demand, U.S. hoteliers need to closely monitor data about the current and incoming supply of soft-branded hotel rooms.