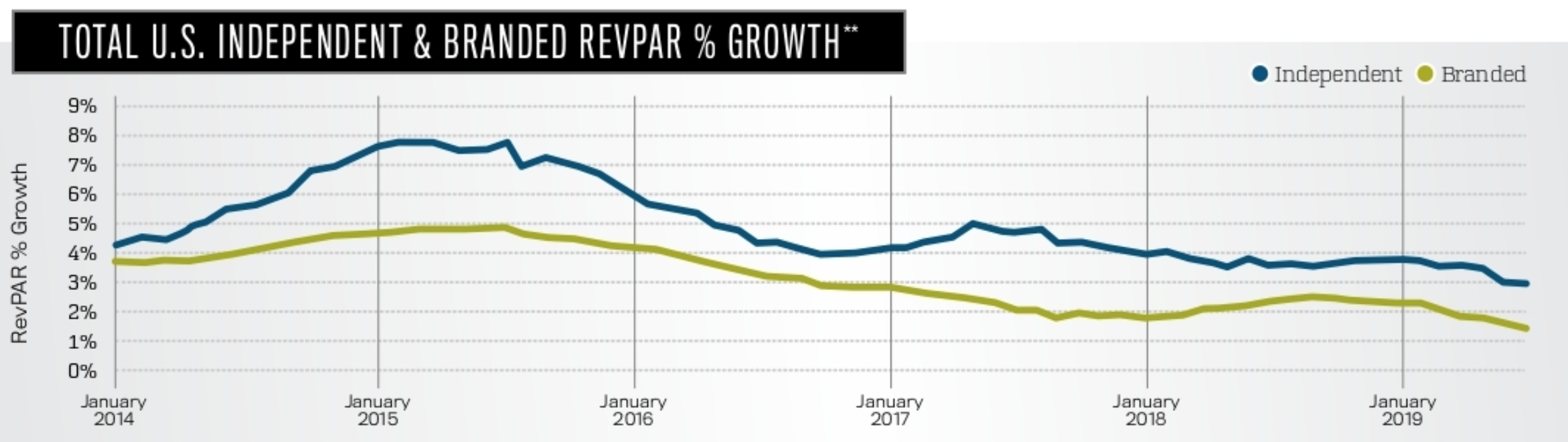

For the past five years, independent properties have outpaced branded properties in RevPAR growth. For the most recent trailing 12-month period ending July 2019, RevPAR growth for independent hotels was 3 percent compared to branded properties’ 1.1 percent.

The RevPAR growth variance is primarily a result of branded properties achieving higher occupancy levels. Branded properties achieve 360 basis points higher absolute occupancy than independent properties. Now that we are late in the cycle, occupancy levels are capping out. This makes it more difficult for branded properties to capture high-occupancy growth, while independent properties can still gain occupancy growth.

Independent properties are growing RevPAR at a faster rate than branded properties in every market segment.

Also, despite independent hotels outpacing branded properties in RevPAR growth, branded properties still have a slightly higher absolute RevPAR value, although that gap is closing. In 2014, average RevPAR for branded properties was $8 higher than independent properties. As of the trailing 12 month (TTM) July 2019 period, the gap is less than $5, with independent properties achieving RevPAR of $83.50 compared to branded properties at $87.87. Prior to 2018, branded properties also achieved higher absolute rates; however, in 2018, independent properties achieved an average daily rate (ADR) of $130.21 compared to branded properties at $129.92. The trend is continuing into 2019, with independent properties’ ADR at $132.41 (YTD July 2019) and branded properties at $131.64 during the same period.

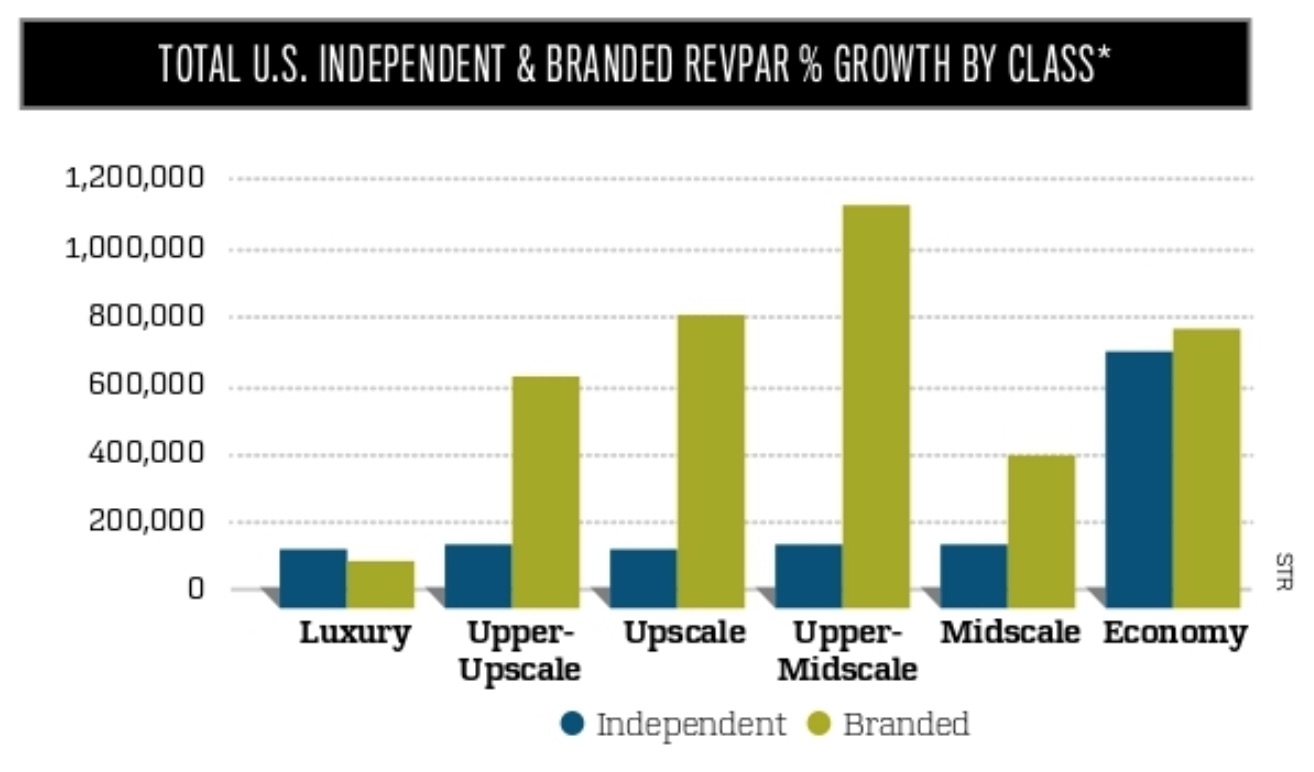

Overall, the number of independent hotel rooms represents less than 30 percent of the total U.S. hotel room count. The number of rooms in the luxury and economy segments is nearly even among independents to brands. The largest variance in supply occurs in the upper-upscale, upscale, and upper-midscale segments, where the majority of rooms are branded.

Independent properties are growing RevPAR at a faster rate than branded properties in every market segment. The highest RevPAR growth for independents occurred in the luxury and upper- midscale segments, while branded properties achieved the highest RevPAR growth in the economy and luxury segments. Branded upscale and upper-midscale segments have both seen supply gains over 4 percent as of TTM July 2019. Independents have shown less than 1 percent supply growth in these segments combined during the same period, which could provide insight as to why it is harder for branded properties to achieve RevPAR growth in these segments.

Higher RevPAR growth doesn’t necessarily mean independent properties are a clear choice. For example, although independents had significantly higher RevPAR growth in the luxury segment, it is actually the largest absolute RevPAR disparity when compared to branded properties. As of TTM July 2019, independent luxury RevPAR was $209 compared to branded luxury RevPAR of $252. This is a $78 RevPAR difference, primarily attributed to branded luxury properties achieving a higher ADR. When comparing the other segments, the largest RevPAR variance does not exceed $23. In absolute values, branded properties achieved higher absolute RevPAR values compared to independents in luxury, upper-upscale, and upscale segments. Independents’ absolute RevPAR values were higher than branded properties for the upper-midscale, midscale, and economy segments.