Over the past decade, the room inventory of U.S. hotel chains has grown more rapidly than that of independent hotels. Current trends indicate this growth will continue as 80.7 percent of rooms currently under construction represent chains.

In 2010, hotel chains accounted for 68 percent of the total U.S. room supply. Today, chains comprise 73 percent of the nation’s total.

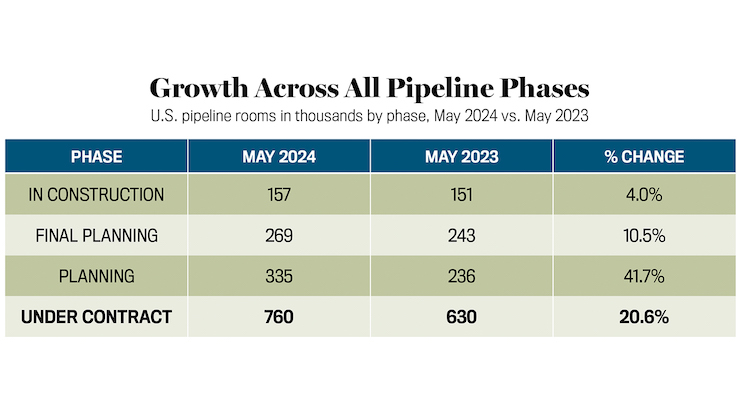

Currently, there are 760,000 hotel rooms in various stages of planning, final planning, or construction, marking a 20.6 percent increase compared to the previous year. Specifically, the number of rooms under construction has risen by 4 percent, totaling 157,000 rooms.

STR classifies hotels in the pipeline based on their chain affiliation, and only 19.3 percent of rooms in construction today represent hotels that are not identified with a chain. Classified as unaffiliated for the purpose of the pipeline, these rooms are assumed to be independent.

Across chain types, upscale and upper midscale (generally grouped together as “select service”) make up half of the construction total, followed in descending order by upper upscale, midscale, economy, and luxury.

Examination of the total pipeline shows upper midscale chains and unaffiliated hotels making up a greater percentage of total rooms compared to the construction phase. That means there are more rooms in planning and final planning across those two segments and fewer rooms in upper upscale and luxury.

Pipeline activity across the Top 25 Markets reveals more activity among unaffiliated properties and upper-level chains. Close to 30 percent of in-construction rooms are unaffiliated and almost 35 percent are in the planning or final planning stages. The nationwide measure, however, falls to 20 percent for the in-construction and planning phases.

Upscale rooms are the second strongest in terms of in-construction and overall pipeline followed by upper midscale. Upper upscale posts a pipeline picture like the United States.

Among the Top 25 Markets (ranked by in-construction as a percentage of total supply), the top four markets present a variety in terms of the mix of chain and independent rooms in the pipeline.

- New York City tops the list with 7 percent of in-construction rooms as a percentage of existing supply. Chains dominate the pipeline in the market, making up 70 percent of rooms compared to unaffiliated (30 percent).

- Phoenix is the next largest market (5.3 percent of in-construction rooms as a percent of total supply) with a 60/40 mix of chain vs. independent rooms in the pipeline.

- Miami, with 4.6 percent of supply in the construction pipeline, shows a 48/52 chain/independent mix.

- Nashville deviates from the norm with a 97/3 mix of chain vs. independent rooms in the pipeline. In-construction rooms make up 4.5 percent of Nashville’s total supply.

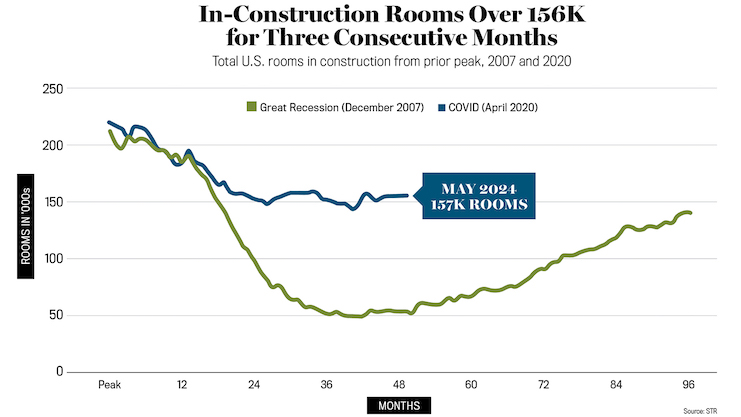

Across the country, hotel development has returned at a remarkable rate when compared to the last downturn. In both this downturn and the last downturn in 2007, the previous peak exceeded 200,000 rooms, and activity took roughly three years from the initial descent to start turning up.

In the last downturn, rooms in construction dropped to under 50,000 before starting to increase. Today, we are already starting to see an increase from a level over three times greater than what was experienced in the last downturn, with the last three months having remained above 156,000 rooms. With the robust pipeline, hoteliers can expect to be challenged with new supply coming online and chains having the upper hand.