A space that combines a hotel and another type of business may make a developer question the myriad ways the hotel and the business’ uses are designed, developed, operated, and maintained. Among the issues are: the nature of the uses within the project; the extent of branding of any component of the project and the requirements flowing from that; and the various economic and control interests of the developer or sponsor (these terms are used interchangeably) versus those of other stakeholders in the project—including brands, lenders, and tenants—all of which will impact the manner in which the various uses are organized.

Project sponsors must have all of these interests clearly in mind at the outset of the development process. To a significant degree, the interests of the developer and lender are aligned. However, the interests of the developer and the brand—assuming there is a brand—are aligned in many, but not all, respects. Therefore, the relationship between the brand and the lender must be negotiated within a complicated and often contentious subordination, non-disturbance, and attornment agreement (SNDA).

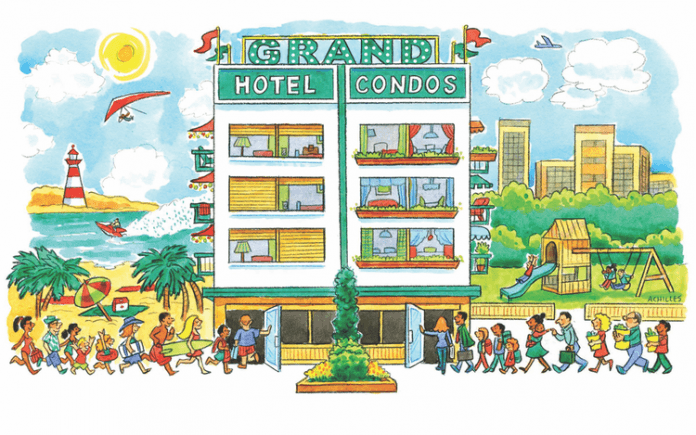

What follows assumes a scenario involving a branded hotel and a residential component.

Who’s in Charge

In any mixed-use project, it is important to establish from the start exactly who or what exerts control over a variety of important issues, which typically include project design and development functions; determination of development standards; project operations, including operating and maintenance standards—both at the level of a single project component and at the level of the entire project; implementation of maintenance standards; the allocation of maintenance costs; and the ability to enforce operating standards.

In a typical mixed-use hospitality project, the sponsor of the project will have the ability to exercise the rights of the declarant under the applicable governance regime. The situation becomes more complex in the context of a project with multiple independent stakeholders with the leverage to require substantial and sometimes conflicting input.

To the extent transient lodging is involved, a mixed-use project is typically shaped primarily by the hotel. If the hotel is to be branded, the design and operating standards established by the brand will be the primary driver of operating standards for the entire project. Although the brand standards applicable to the hotel will not necessarily carry over to other elements of the project verbatim, it may be necessary to impose an operating standard comparable to or at least not incompatible with the hotel operating standard. It is essential, however, that, in providing for these standards across the project, allowances are made for the possibility that the hotel brand may be terminated or changed in the future. Additionally, care must be taken in how the standards are described, as branding companies do not want their names/marks to be incorporated into the governance documents.

Another important aspect of maintaining project standards is the issue of enforcement if a stakeholder in the project does not maintain the required standards. Typically, the declarant under the governance regime can evaluate compliance with project standards and require action to address failures to maintain the standards. Ideally, the declarant will have the right to exercise self-help in the face of a noncompliant stakeholder and also the ability to charge back the cost of achieving compliance as an assessment payable by the noncompliant stakeholder.

Allocation of Operating Costs

One of the primary subjects of dispute within mixed-use projects is the allocation of post-opening capital expenditures and operating costs. Proper project design must include a detailed assessment of all the physical and operational aspects of the project that benefit each stakeholder and provide metrics for an appropriate allocation of these costs. Creating the template for appropriate cost allocations is essential, and it must be documented in a manner that will support the developer/hotel owner in the event of a challenge. It is equally important to assure that the manager implementing the budgeting and cost allocations carefully follow the provisions set forth in the governance documents, although material deviations between the governance documents and actual assessments are not uncommon.

Rental Programs & Securities Laws

Where the residences are branded, it is important to consider whether the residences may be placed in a hotel rental program operated under the brand, and whether there will be a separate swimming pool/pool deck, fitness center, etc., for the benefit of the residences. The offering of a rental program opportunity is impacted extensively by federal securities laws that address the question of whether the sale of a condominium—in combination with an opportunity to realize a profit based on the managerial efforts of the rental program operator—constitutes an investment. Most often, an attempt is made to avoid characterizing the sale as an investment because the registration process and the implications for sales and marketing activity are cumbersome, costly, and impose a considerable delay in the sales and marketing process. It is important to avoid any suggestion that the sale is an investment, as a security requires a complicated analysis; the lender and brand—if applicable—as well as the developer will require a strong indemnity against the impact of securities law violations, sometimes backed by a personal guarantee of the principals of the sponsor.

Hotel Branding

In considering a hotel brand, it is important to address the issues that exist in any branded hotel management agreement, plus several that are peculiar to a branded mixed-use project. One of the first questions for the brand is whether it will permit branded condominium hotel units—it should be assumed that the brand will not permit unbranded condominium hotel units, although there are many exceptions—or branded or unbranded residential units. In the context of a branded condominium hotel or residential units, a brand will want to maintain long-term management of the relevant property owners’ association for the duration of its hotel management agreement. While there are some U.S. jurisdictions in which this long-term control over the association and its management can be maintained, they are the exception, particularly in states that have robust consumer protection provisions embedded within their condominium and power of attorney legislation.

This issue is relevant not only to a hotel brand but also to the hotel owners, who will want to protect their long-term interest in the hotel. A careful analysis of the project and the legislative environment is necessary to determine how the interests of the brand and the hotel owner can be best protected. As such, it is especially important to determine whether the brand will seek a cross default or automatic cross termination of the hotel management agreement with a termination of its management of a residential condominium association. There are nuances to this question that are worthy of discussion with the brand.

Commonly, a brand will not permit unbranded residences to be associated with a branded hotel, be the connection one of physical proximity, sharing of services or facilities, or otherwise. In this context, consider whether or not an unbranded condominium that can be sufficiently screened off from the branded hotel through landscaping or other physical barriers, and whether residents will be able to enjoy shared parking facilities, landscaping, access roads, valet services, swimming pools, health clubs, spas, building engineers, electrical and mechanical systems, and HVAC.

While there is more to consider in connection with a mixed-use hospitality project, the foregoing are the major touchpoints for consideration. Careful planning and proper structuring of a mixed-use project will determine whether the project benefits from synergies among various uses or experiences challenges.