For the past four years, the opening of dual-branded properties has been very popular among hotel developers. The perceived benefits of building a property with two or more brands are many:

-

- Two reservation systems to channel business to the property

- Two brands that will appeal to different demand segments in the market

- Enhanced ability to maximize land density requirements

- Efficiencies in the construction of the facility (e.g., one laundry room for two hotels)

- Efficiencies in the operation of the hotels (e.g., shared staffing)

Using data from CBRE’s annual Trends in the Hotel Industry survey of operating statements from thousands of hotels across the United States, we conducted an analysis that tested the theoretical operating efficiencies of a dual-branded property. The hypothesis is that operating two hotels within one structure should allow management to achieve operating efficiencies because of shared services, labor, management, and facilities.

Within the Trends database, we identified 25 operating statements for dual-branded hotels for the year 2017. Two of the properties were removed as outliers because of the large number of combined rooms and urban location within a major market. In aggregate, the remaining 23 properties averaged 309 rooms in size, a 2017 average daily rate (ADR) of $171.69, and an annual occupancy of 75.9 percent.

In the survey sample, we observed three different combinations of property types: limited-service and select-service (3 properties); select-service and extended-stay (13 properties); and limited-service and extended-stay (7 properties).

For each of the property types of each of the dual-branded hotels, we selected 2017 operating statements from the Trends database for comparable properties that were single-branded hotels. The statements for the comparable properties were selected based on property type, number of rooms, occupancy, and ADR. The comparable statements were then added together to match the size and performance of the respective dual-branded hotels.

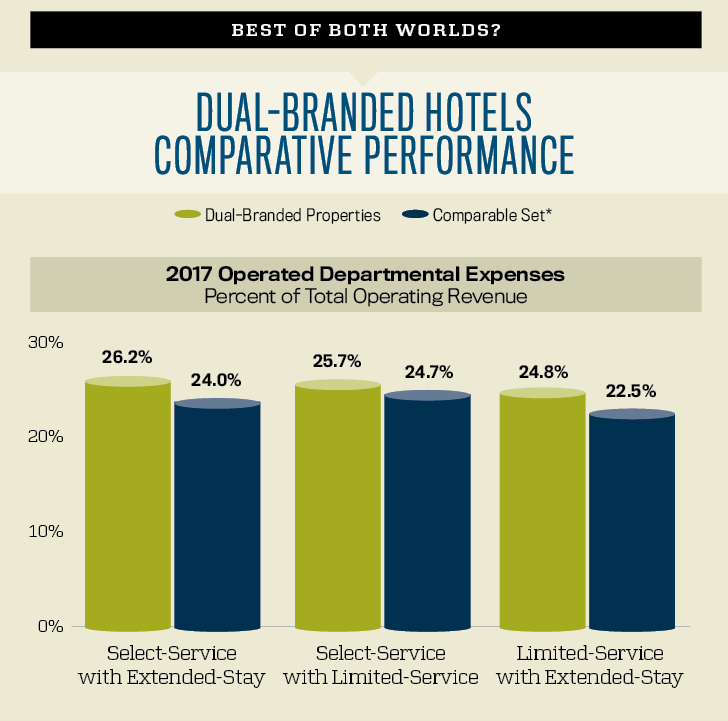

Operated Departments

When comparing total operated department expenses as a percent of total operating revenue, we did not find any efficiencies achieved by the dual-branded hotels. Across all three categories, the operated department expense ratios for the dual-branded properties were greater than the comparable groupings.

Since the dual-branded properties in our analysis were either limited-service, select-service, or extended-stay hotels, the rooms department comprises the majority of total operated department expenses. Further, within the rooms department, labor costs average over half of the expenses. Therefore, it is reasonable to assume that a dual-branded hotel would benefit from sharing front desk, housekeeping, laundry, and bell staffs.

Unfortunately, these labor efficiencies did not appear to materialize. Across the board, the rooms department ratios for the dual-branded hotels averaged 22.8 percent, compared to 22.0 percent at the comparable properties. Rooms department operating efficiencies were only observed at select-service/limited-service dual-branded properties. From discussions with our clients, we understand that brand standards frequently require discrete check-in areas and employee uniforms within dual-branded hotels. Such requirements limit the ability of operators to benefit from shared staffing.

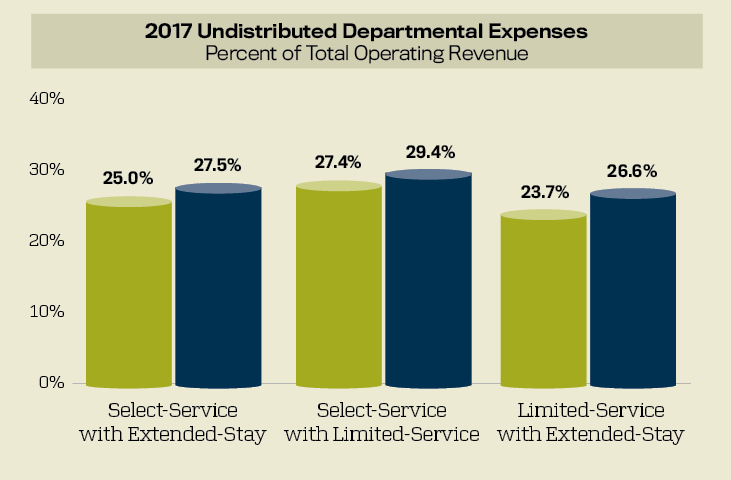

Undistributed Departments & Profits

Undistributed departments in hotels are more administrative in nature and less guest-facing than the operated departments. It is in these overhead departments where we observed the greatest operating efficiencies for the dual-branded properties. Measured as a percent of total operating revenue, the dual-branded hotels achieved undistributed department expense ratios two to three percentage points less than their respective comparable properties across all three property combination categories.

Less encumbered by brand standards, it appears that hotels are able to share staffing for such back-of-the-house functions as general management, accounting, security, marketing, and maintenance. Further, they were more energy efficient.

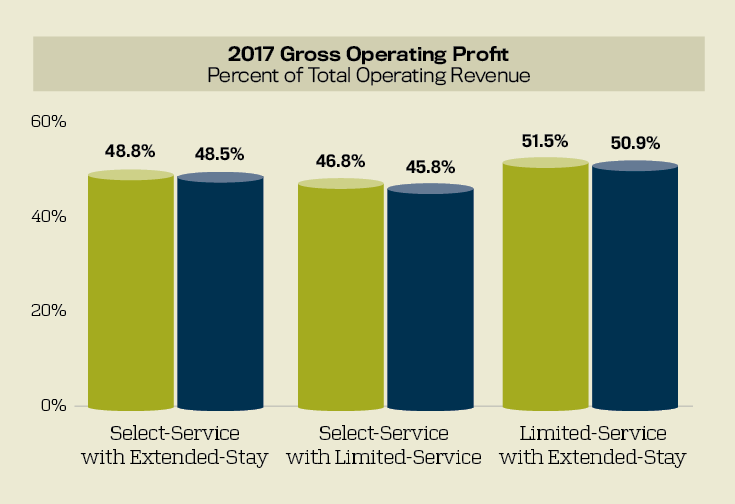

Based mainly on the ability to achieve operating efficiencies within the undistributed departments, the dual-branded hotels on average did achieve slightly greater profit margins compared to corresponding single-branded properties. This was true across all three categories. Since we were measuring operating efficiencies, profit for this analysis was defined as gross operating profit.

This finding of just “slightly better” profit margins is consistent with a similar analysis performed by CBRE in April of 2015. Since it is widely believed that operating efficiencies are a major benefit when developing a dual-branded hotel, owners of these properties should be careful not to base the financial feasibility of their project solely on expectations of greater profit margins.

As noted earlier, there are several other benefits that dual-branded hotels provide. These benefits help to improve revenues (two reservation systems) and reduce development costs (shared amenities such as a pool, exercise room, and meeting space). It is these factors that may end up being most important when determining if a dual-branded hotel is the appropriate property type to develop.