This year, STR’s host P&L program collected P&L data for over 10,000 hotels globally, with more than half of the sample coming from the United States. The data continues to demonstrate modest revenue gains coming primarily from inflationary rate growth and flat occupancies. The main story of 2018, however, was that other revenue sources—such as F&B and other operated departments (spa, parking, minor departments, etc.)—achieved larger revenue gains relative to the lackluster growth levels of the rooms department. Full-service hotels specifically benefitted from growth in group demand, and illustrated an inclination to increase pricing in F&B and other operated departments, despite a hesitancy or inability to meaningfully increase ADR. Miscellaneous income realized the largest revenue gains for the fifth year in a row, continuing to demonstrate an industry-wide emphasis on fee-based revenues, specifically resort fees and cancellation fees.

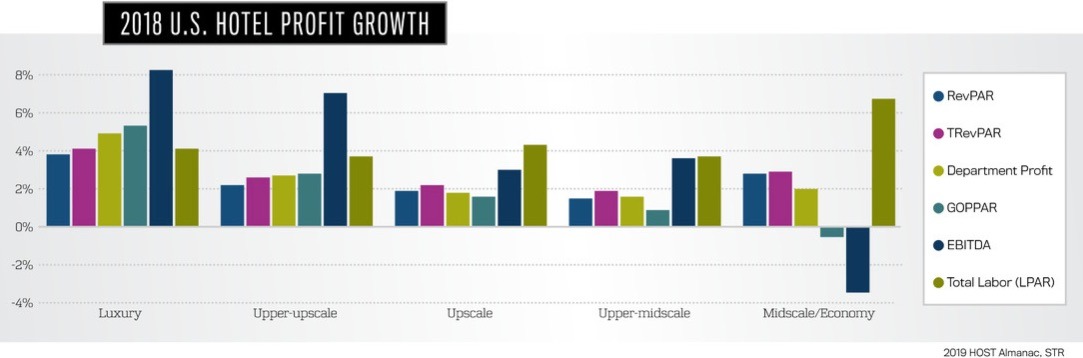

Full-service hotels continued to be top performers, achieving house profit—i.e., gross operating profit per available room (GOPPAR)—gains of 3.2 percent in 2018, while limited-service hotel profits increased only 1.1 percent. Administrative and general (A&G) and insurance expenses exhibited some of the strongest growth in 2018, both increasing more than 4 percent, which is a reversal from recent years in which these expenses saw little growth or even declines. The luxury class led the way in profitability gains by a large margin, with 5.3 percent GOPPAR growth, while all other classes experienced lesser profit gains in descending class order. In fact, the midscale and economy classes realized slight profit declines of 0.5 percent this past year.

While growth levels in 2018 were relatively muted compared to three and four years ago, the industry continues to build on peak levels of profitability. However, despite these profit gains, profit margins have fallen for three straight years. STR found that just over 50 percent of U.S. hotels in the sample increased profits in 2018. Overall, the GOP profit margin for 2018 was 37 percent of total revenues, down from 38.4 percent achieved in 2015.

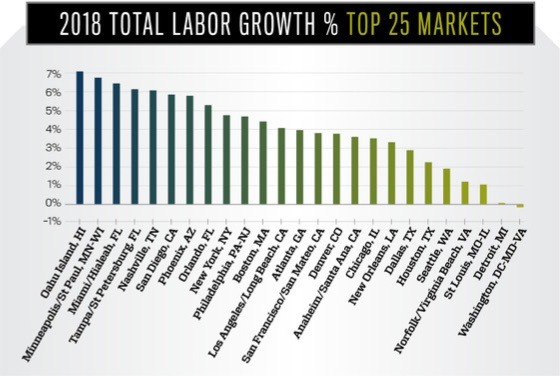

Two primary reasons for declining profit margins during the past few years have been weak revenue growth and growing labor costs. Labor cost growth accelerated in 2018, growing 4 percent, up from 3.2 percent growth in 2017. Labor costs are growing even more in many of the top markets. Oahu experienced 7.1 percent growth in 2018, while labor costs in Minneapolis, Miami, Tampa, and Nashville all experienced increases of more than 6 percent. In fact, 18 of the top 25 markets experienced labor cost growth of more than 3 percent. This is the second year in a row that labor costs have significantly outpaced revenue growth. The industry can expect more of the same for 2019, as revenue growth continues to disappoint, and labor costs continue to rise throughout the country.