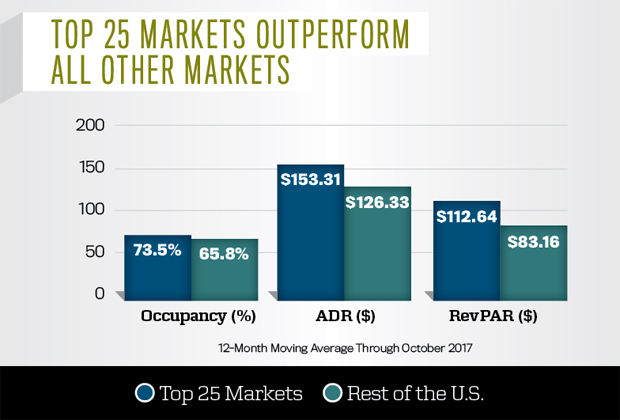

Of the 168 markets that STR tracks around the United States, 25 are delineated as the “Top 25 Markets.” They are not necessarily the largest markets, but those that, as a group, give the best indication of performance in the larger metros around the country. The performance of these top 25 markets has been stellar since the Great Recession. After the downturn, their occupancy increased from just under 60 percent in 2009 to 75 percent for the 12 months ending in October 2017. ADR increased by 30 percent to $153, and RevPAR increased a strong 60 percent to around $112 in the same time period. The strong performance was driven by the continued healthy influx of business, leisure, and group travelers. In 2009, the top markets made up 31 percent of all U.S. rooms and 34 percent of all demand. Through October of 2017, the supply ratio stands at around 32 percent, but the demand share has slightly increased to 36 percent.

ADRs have traditionally been much stronger in the larger markets than in all other markets. From January to October 2017, there was an ADR difference of $41 between the top 25 markets (ADR of $154) and other markets (ADR of $113). This is probably not surprising, since larger markets attract more of the larger, high-end hotels and also have more citywide conventions, which in turn leads to compression nights and pricing power for hoteliers. More telling, though, is the ADR percent change in 2017.

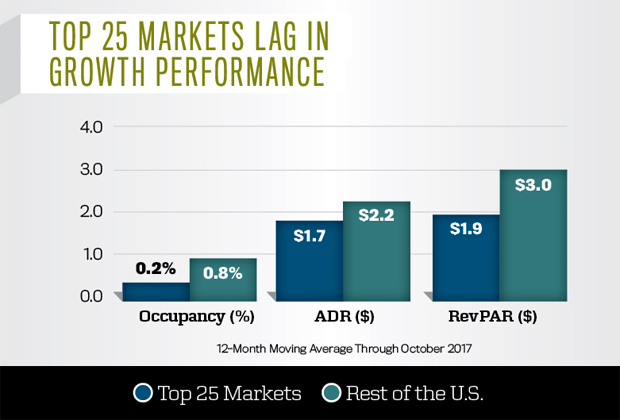

The top 25 markets underperformed the already anemic U.S. average growth of 2.1 percent, and ADR only grew by 1.6 percent. The U.S. average was helped by markets outside the major metros, which were able to increase room rates by 2.4 percent. One reason behind the slowing in room rate growth may be the rapid increase in new rooms on the larger markets. For 2017, the increase in supply stood at 2.4 percent, compared to only 1.5 percent in all other markets. Clearly, there is some trepidation among revenue and general managers about increasing room rates, despite the high absolute occupancies, when so much new competition is opening or about to open in the near future.

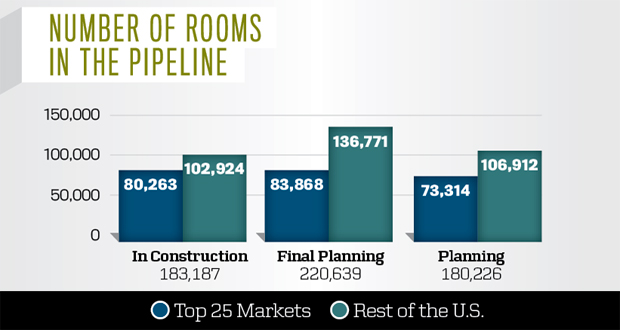

We do not expect the attractiveness of the larger market to slow any time soon. STR’s pipeline report shows that of the 183,000 rooms in construction in the United States, some 44 percent are being built in the larger markets. Clearly, developers and lenders feel that the larger markets, despite their already crowded marketplace, are a good bet going forward. The growth percentages may not be anything to write home about, but the old adage is still true: You take dollars—not percentages—to the bank.

About the Author

Jan Freitag is senior vice president at STR.