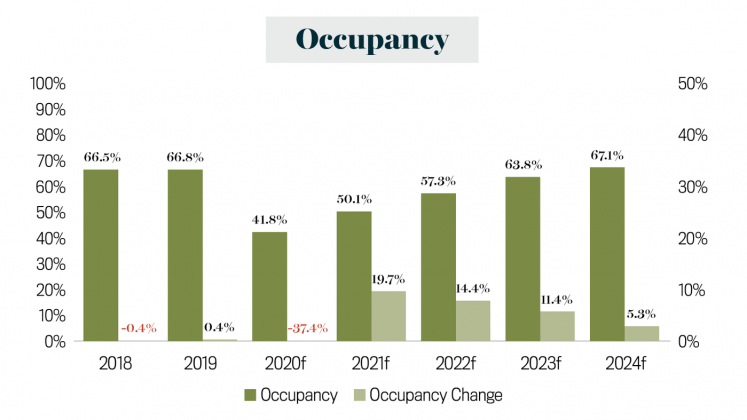

While the surge in COVID-19 infections during the last few months of 2020 dampened expectations through the first half of 2021, news of effective vaccines solidified the projections that U.S. lodging industry recovery would begin in earnest during the second half of the year. According to the Q3 2020 edition of Hotel Horizons, published in early December 2020, CBRE Hotels Research forecasts an average national occupancy level of 44.4 percent during the first half of 2021. This measure increases to 55.7 percent during the second half of the year.

As of early December 2020, the increased spread of the COVID-19 virus, combined with the lack of an economic stimulus package, served to lower CBRE’s outlook for the performance of U.S. hotels during the first six months of 2021. This second wave of infection has—and will—result in the reinstatement of restrictive social distancing regulations that limit both group and individual travel.

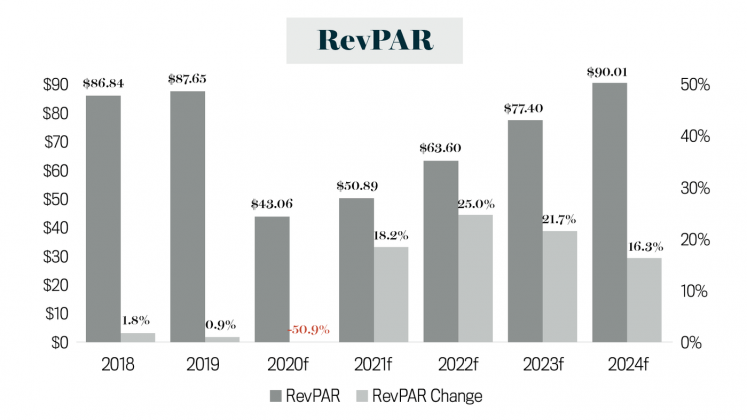

CBRE’s Q3 2020 forecasts call for the U.S. lodging industry to return to 2019 occupancy, ADR, and RevPAR levels in 2024. In general, properties that operate in the lower-priced chainscale segments will recover to 2019 performance levels sooner than the higher-priced hotels. One exception is luxury hotels; while occupancy levels in this segment have declined significantly during 2020, CBRE has observed some relative stability in room rates. It appears that leisure travelers who prefer luxury accommodations continue to have the means to pay the price premium.

CBRE Hotels Research forecasts an average national occupancy level of 44.4 percent during the first half of 2021. This measure increases to 55.7 percent during the second half of the year.

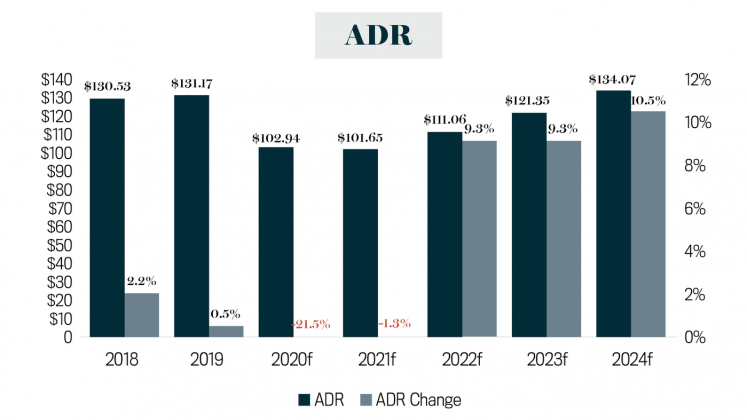

The diverse impact of COVID-19 on different traveler groups becomes evident when analyzing changes in lodging demand by chain scale. Luxury and upper-upscale properties are most dependent on businesspeople and conventioneers, and will see their demand levels decline in excess of 60 percent in 2020. Conversely, hotels operating in the economy and midscale segments will see their business fall off by less than 25 percent. The confidence provided by an effective vaccine will serve to sustain the relatively strong leisure travel patterns observed during the summer of 2020, plus initiate a significant return of corporate travelers during the second half of 2021. Group demand, on the other hand, will lag in recovery because of the advance booking nature of this segment. The prospects for improvement in average daily room rates (ADR) during 2021 are influenced by these demand patterns. CBRE foresees annual increases in ADR for each of the three lower-priced chain scales, but continued declines in ADR for the higher-priced segments. Overall, CBRE is forecasting a 1.3 percent decline in ADR for U.S. hotels during 2021.

Because of the extreme movements in demand and ADR during 2020, prior year comparisons during 2021 may be misleading. The entirety of the national ADR decline forecast for 2021 occurs during the first quarter when year-over-year performance is compared to the relatively strong pre-COVID first quarter of 2020. Taking a longer point of view, the outlook for inflation has risen somewhat since CBRE’s last forecast, which has served to increase the prospective pace of ADR growth beyond 2021. Further bolstering pricing power for U.S. hoteliers is a deceleration in new hotel construction activity. CBRE forecasts U.S. hotel supply to increase by 1.8 percent in 2020, and another 1.4 percent in 2021. However, net supply gains are projected to dip below 1.0 percent in 2022, thus lowering the impact of new competition concurrent with the recovery in lodging demand.

While revenue recovery may occur in 2024, some hotels may see profits return to 2019 levels earlier. U.S. hotel operators have enacted effective cost control measures in 2020 to offset the severe declines in revenue. Like in the past two recessions, CBRE believes these austerity measures will remain, thus perpetuating the operating efficiency trends observed since 2000. Gross operating profits are estimated to have declined by 80 percent in 2020. However, pent-up travel demand, effective vaccines, suppressed construction levels, sound long-run economic fundamentals, and new operating paradigms all serve to hasten the pace of recovery.