ARLINGTON, Va. — Knowland, provider of data-as-a-service insights on meetings and events for hospitality, released its monthly meetings and events data for April 2022, reporting a significant increase of 323 percent over April 2021. Despite the normal cooling factor of the Easter holiday, there was still a 3.7 percent recovery of events from March to April 2022.

Attendees were ahead of 2019 levels in April 2022, with the average number of attendees per event at 118, compared to 63 in April 2021 and 74 in April 2019.

The average space used in April 2022 was 3,185 square feet. Meetings in April 2021 averaged 2,640 square feet and 2,322 square feet in April 2019. Proportionally from a per person perspective, the 2022 meeting space used averaged 27 square feet per person as opposed to 42 square feet per person in 2021 and 31 square feet per person in 2019. The lower square footage per person is a sign people are growing even more comfortable meeting in smaller spaces.

Compared to March, April’s top five growth markets were Denver, Chicago, Minneapolis, Colorado Springs, and Kansas City, respectively.

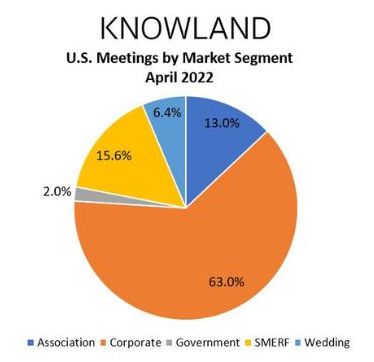

The corporate segment represents 63 percent of meeting and event business with technology, healthcare, and training/education taking the lead as the largest industry groups. From a recovery standpoint compared to April 2019 levels, online retailer, tobacco, charity org/social services, and biotechnology are the segments at the highest level of recovery capture in April 2022.

Kristi White, chief product officer, Knowland, said: “The Easter holiday always takes a toll on meetings and events. This month was no exception but even with the holiday, there was moderate growth month over month. Additionally, for April, the market was 66 percent recovered compared to April of 2019. This is stronger than March recovery at 64.7 percent. So, while the month-over-month growth is not as high as prior months, the level of recovery to 2019 is growing.”

The insights presented are a result of the analysis of meetings and events data acquired through Knowland data collection and aggregation methods, including field reporting and automated methods of customer and non-customer data collection in primary, secondary, and tertiary markets, as well as its large historical database.