For hotels in the upper tier of the market, a successful conference and group season involves a healthy contribution from F&B departments. If the opening quarters of the year were any indicator, however, hoteliers will see tighter profit margins with inflation continuing to affect revenues and expenses.

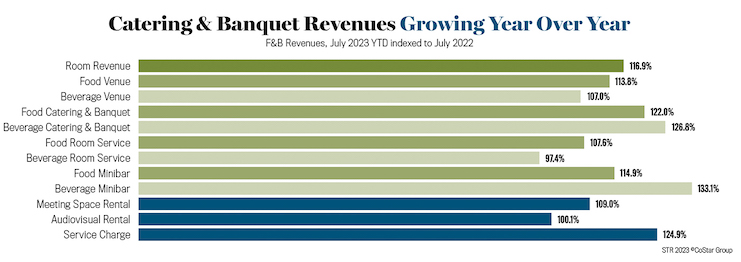

Through the first seven months of 2023, most F&B revenues easily exceeded last year, most notably beverage catering and banquet (C&B) coming in almost 27 percentage points higher and food C&B 22 ppts higher. When adjusting the lens to a per-occupied-room (POR) basis, most of those levels were down a bit, albeit by no more than $1, which would seem to signal a slight increase in demand.

The balancing act for optimizing profit levels takes on added importance for hotels that rely more upon business travelers and conference attendees. Using July year-to-date metrics, total U.S. revenues of course came primarily from rooms departments (69 percent or roughly $210 POR). F&B was next at 23 percent of total revenues ($72 POR). However, the latter percentage grows when focusing on the luxury (30 percent) and upper upscale (27 percent) classes—two segments of the market synonymous with corporate demand this time of year. Upscale hotels are also closely associated with business travelers but come in far lower in F&B contribution.

From that group, upper upscale hotels are the most reliant on events-related income. The segment obtained close to 73 percent of F&B revenues from C&B, audiovisual, meeting room rental, service charges, and other F&B. Only 27 percent of revenues came from outlets, nearly half of what upscale hotels reported for that area.

Luxury class is next at 63 percent, partly due to a combination of room service and minibars being more active than in any other hotel class, generating 3 percent and 1 percent of F&B revenues, respectively. The fact that luxury hotels reported 6 percent of revenues coming from other operating departments—the highest allocation among all classes—also signals the wider revenue channel diversification for this class.

On the expense side of F&B operations, we haven’t seen massive increases from last year, but there’s been enough of a jump to affect margins. Of note, wages increased more than one ppt due to inflation and rising labor costs with more competition to attract/retain talent. This rise in labor costs along with those in other F&B expenses leave the overall F&B profit margin at 28.6 percent—down from 29.5 percent during the same period last year.

The industry has yet to book the same volume of events as before the pandemic, but pre-fall indicators pointed to a strong season ahead. Despite costs outgrowing revenues, F&B profits past the first half of the year only decreased 0.9 ppts from 2022 (or -0.4 ppts from 2019). Hoteliers have done a lot of work to walk the fine line between increasing costs and decreasing some offerings just enough to not disrupt guests’ expectations. More of that will be needed with a higher volume of groups and conferences meeting a higher-cost environment.