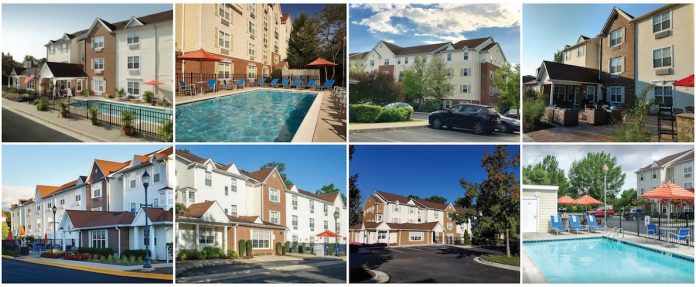

Atlanta, Ga., Denver, Colo., and Tampa, Fla. — HREC Investment Advisor, a hotel real estate advisory firm, announced that it has exclusively arranged the sale of eight TownePlace Suites branded hotels with 834 rooms located throughout the United States. The portfolio was acquired by an affiliate of Three Wall Capital (TWC) for an aggregate sales price of $45.3 million. Upon acquisition, TWC converted seven hotels to the Extended Stay America brand and one to the Candlewood Suites brand.

HREC Investment Advisors exclusively represented Service Properties Trust, the seller, on this transaction. The marketing and negotiations were led by Scott Stephens, COO and senior principal, in HREC’s Tampa office and Monty Levy, managing director, in HREC’s Atlanta office. Also assisting in the transaction were Jim O’Connell, principal in HREC’s Boston office, Ketan Patel, managing director in HREC’s Washington D.C. office, and Scott Kaniewski, managing director in HREC’s Chicago office.

Founded in 2008 by Alan Kanders, Three Wall Capital has completed over $1 billion in transactions in a principal investor capacity since inception. TWC invests with the philosophy that hotel real estate is subject to both short- and long-term cycles, and therefore, opportunistically invests in product type ranging from limited service to luxury hotels. TWC’s current investment strategy is to acquire and develop midscale extended-stay hotels in markets with strong growth outlooks in terms of population, disposable income, jobs, diversity of high-quality food and beverage experiences, retail offerings, and office space.

Three Wall Capital’s portfolio includes 61 hotels across 12 states.