ATLANTA, Georgia—The RADCO Companies has acquired the DoubleTree by Hilton in St. Augustine, Florida, a 97-key hotel located in the Historic District. Scott Stephens, Paul Sexton, and Tammy Bateman of Hospitality Real Estate Counselors (HREC) brokered the sale. Additional terms of the deal were not disclosed.

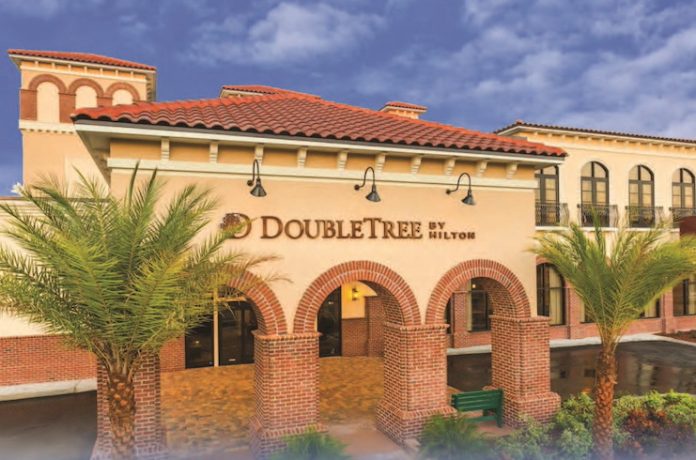

Located in one of the getaway markets along the southeastern Atlantic Coast in a beach-oriented setting, the DoubleTree by Hilton includes a pool, hot tub, fitness center, 24-hour business center, and the Oakroom Restaurant and Lounge.

The deal marks the eleventh acquisition by RADCO’s new hotel division, launched in 2021 in response to the COVID-19 pandemic’s operational and capital markets disruptions in the hospitality sector. The firm previously acquired four hotels in the Atlanta market and six Florida properties in the Panhandle and St. Petersburg. RADCO is seeking hospitality assets that are in line with the company’s overall investment strategy, according to CEO Norman Radow.

“DoubleTree by Hilton in historic downtown St Augustine is an incredible asset in an absolutely perfect location,” said Radow. “The hotel is already performing extraordinarily well, and we intend to invest in significant upgrades to improve and modernize the customer experience.”

Nicoletta DeSimone, vice president, capital markets—equity and debt, said, “We are extremely excited to add this asset to our growing hotel portfolio. It aligns seamlessly with our previous hotel acquisitions in high-octane markets. RADCO is poised to continue our expansion in the hospitality space by searching for unique opportunities in compelling locations during this challenging time in the capital markets.”

The RADCO Companies has a 28-year history of acquiring and investing in real estate across all asset classes. The firm’s investment strategy targets underperforming assets that offer mark-to-market opportunities, as well as projects requiring capital infusion. RADCO seeks out properties that have limited access to institutional debt or equity capital for a variety of reasons.

“The purchase of the DoubleTree St. Augustine represented a truly rare opportunity to acquire a premier, compact full-service hotel located in a high barrier to entry market in one of the most sought out leisure destinations in the country,” said Bhavnesh Vivek, vice president of hotel acquisitions. “This acquisition caps off a busy 2022 in which RADCO purchased nine hotels, including eight in the last three months. RADCO plans to continue to deploy capital in the hospitality industry in 2023.”

Acquired at a basis below today’s replacement cost, RADCO was attracted to the property’s Hilton brand affiliation in a market that has seen growth with more coming through continued mixed-use development.