2020 kicked off with slight increases in both total revenues and gross operating profits, however, record industry highs quickly changed to record lows. Approximately 9 percent of U.S. hotels temporarily closed, and those that remained open were very limited in their ability to retain any sort of revenues, and consequently, profits.

After the initial lows at the beginning of the pandemic and slight improvement during the summer months, hotel recovery was presumably linear. Summertime travel eventually concluded and COVID-19 cases spiked in the fall. Paired with the lack of conference season and weak business travel, hotel demand and revenues ultimately dwindled month by month, leaving December with the steepest gross operating profit per available room (GOPPAR) decline since the spring (-100.6 percent). Looking at full-year 2020, demand declined more than 54 percent, which led to total revenue per available room (TRevPAR) to account for only 35 percent of 2019 levels. Despite a clear effort to control and minimize all expenses, hoteliers struggled to produce profits given the challenging circumstances 2020 presented. GOPPAR dropped from $94.72 in 2019 to only $14.62 in 2020. EBITDA PAR was even worse, declining over 103 percent from $70.01 to -$2.34.

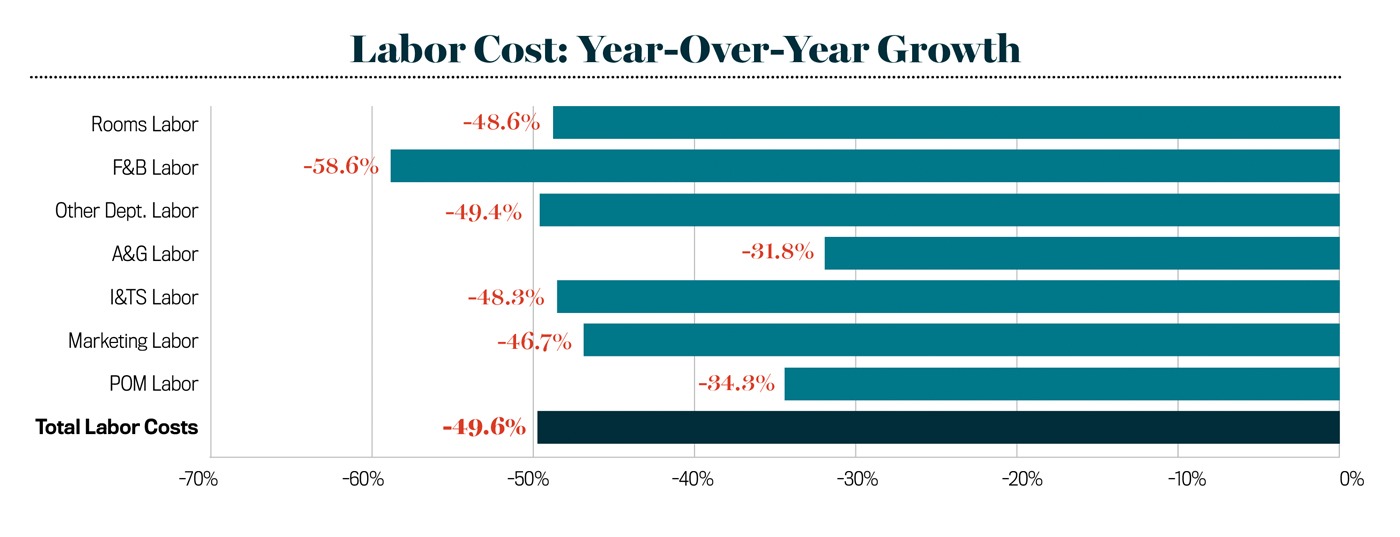

As a response to reduced demand, total labor costs declined 50 percent in 2020.

As a response to reduced demand, total labor costs declined 50 percent in 2020. The most impacted labor departments were within rooms and F&B, departments whose labor requirements are heavily driven by hotel occupancy. Departments like administrative and general, property operations, and maintenance saw the smallest year-over-year declines in labor expense, albeit still more than 30 percent. Despite many hotels operating on a “skeleton crew” and seeing a large reduction in labor costs, nearly 48 percent of revenues were still going to this expense, leaving very little room for a profit margin.

Although 2020 seemed to level the playing field and create losses for all hoteliers, it quickly became very apparent that limited-service hotels would prevail in terms of profitability, while full-service properties struggled. The limited expenses and ability to more easily control costs allowed limited-service hotels to achieve profits at a lower occupancy than what is required of full-service hotels. In 2020, limited-service hotels had profit margins double the size of full-service hotels, and approximately two out of three limited-service hotels remained profitable. Despite the tremendous struggle of full-service hotels and significantly diminished F&B revenues in 2020, the final month of the year did show a slight month-over-month increase in F&B revenues. Some full-service hoteliers have gotten creative to generate revenues, using un-booked hotel rooms to offer private dining experiences, bypassing the dining restrictions some cities imposed. The most impacted areas within F&B were catering and banquets revenues, and unsurprisingly, the least impacted were room service revenues, which were about 40 percent of their revenues in 2019.

Although 2020 seemed to level the playing field and create losses for all hoteliers, it quickly became very apparent that limited-service hotels would prevail in terms of profitability, while full-service properties struggled. The limited expenses and ability to more easily control costs allowed limited-service hotels to achieve profits at a lower occupancy than what is required of full-service hotels. In 2020, limited-service hotels had profit margins double the size of full-service hotels, and approximately two out of three limited-service hotels remained profitable. Despite the tremendous struggle of full-service hotels and significantly diminished F&B revenues in 2020, the final month of the year did show a slight month-over-month increase in F&B revenues. Some full-service hoteliers have gotten creative to generate revenues, using un-booked hotel rooms to offer private dining experiences, bypassing the dining restrictions some cities imposed. The most impacted areas within F&B were catering and banquets revenues, and unsurprisingly, the least impacted were room service revenues, which were about 40 percent of their revenues in 2019.