The booming industry recovery has touched chains and independent hotels alike, but the role of supply growth in that recovery has varied across the two segments.

After a 2022 that produced just a 1.8 percent increase in U.S. hotel supply, the first five months of 2023 resulted in a lift of just 0.3 percent. Given the seemingly never-ending pent-up leisure business, this slow supply growth has only added to hoteliers’ already strong pricing power built on near-record levels of demand in an inflationary environment.

When comparing chains versus independent properties, however, it has been the latter that has benefitted more from less competition coming to market. Through May, independent supply has actually declined 0.4 percent, while the volume of chain rooms increased 1.2 percent. Looking further back to 2019, the difference is even more dramatic with independent supply decreasing 2.2 percent and chain supply up 4.7 percent.

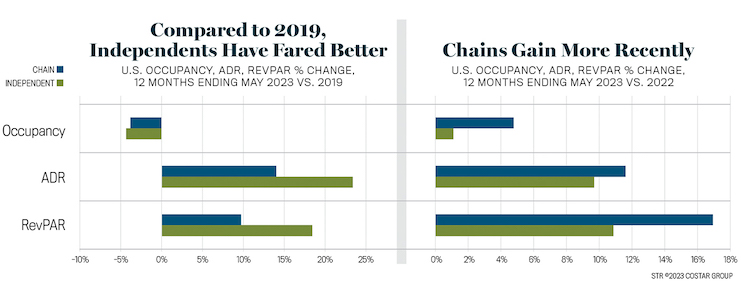

The middle tiers (upper midscale and upscale) are where the greatest supply decrease has occurred among independent hotels, and it is these same tiers that have experienced the greatest supply increase among chain hotels. When measuring against the pre-pandemic performance benchmark, independents and chains still see similar occupancy deficits to 2019. Independents have achieved greater gains in ADR, and in turn, RevPAR. This difference between independents and chains has been partially driven by a change in supply mix with fewer mid-tier hotel rooms among independent hotels and more mid-tier hotel rooms among chain hotels.

When comparing against last year, chains are further ahead in growth.

The Future of Supply Growth

Looking ahead, supply growth projects remain manageable around the industry with construction volume having stabilized at just over 150,000 rooms. The level at which development has stabilized is remarkable when compared to the last downturn. In each case, the previous peak exceeded 200K rooms, and activity took roughly three years from the initial descent to start turning up. In the last downturn, rooms in construction dropped to under 50K before starting to increase, whereas today it appears that we are already starting to increase from a level over three times greater than what was experienced in the last downturn. When breaking down the construction figures of today, it is no surprise that chains will continue to be the segment facing more competition. The largest companies (IHG, Choice, Hilton, Hyatt, Marriott, and Wyndham) account for 80 percent of all rooms in the active pipeline. In 2010, the “Big 6” accounted for less than 60 percent of the pipeline. While chains and independents have each been examples of the industry’s incredible resilience in recent years, there is no doubt that chains remain the popular choice for portfolio growth in the years ahead.