Strong loyalty programs help hotel brands lower customer acquisition costs, increase direct-to-consumer access, and offset occupancy shortfalls during shoulder periods and weaker economic conditions. After analyzing publicly available data from five large hotel companies, we found that while growth in several key metrics slowed in 2023, loyalty members’ overall contribution to occupancy increased, though marginal contribution per member contracted.

Benefits

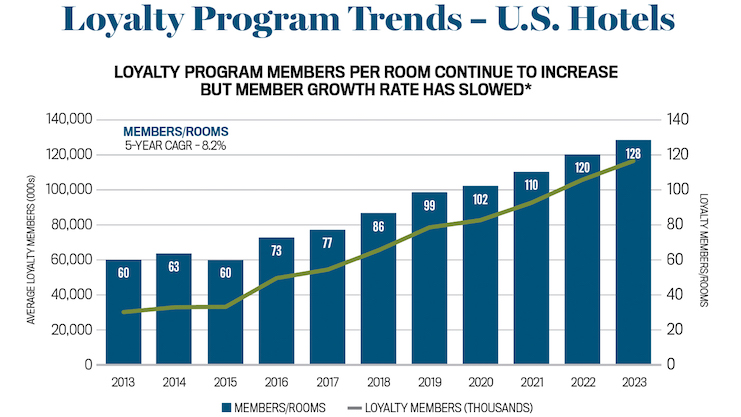

The average number of loyalty program members at the subject five companies increased 11.3 percent in 2023, slower than the 15 percent growth rate in 2022. Members-per-room increased 6.4 percent year over year from 120 to 128.

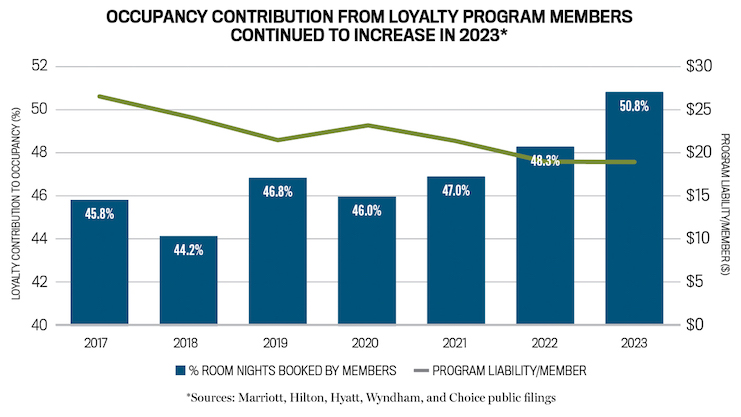

The average contribution to occupancy from loyalty members grew to nearly 51 percent in 2023, up from roughly 48 percent in 2022. However, loyalty programs are becoming less dominated by frequent travelers (+30 nights a year). The number of room nights booked by the average loyalty member in 2023, 1.1, returned to 2019 levels last year. This is well below the 1.8 nights stayed per member in 2016, suggesting that the percentage of membership comprised of heavy users is declining as the programs have become more tied to credit cards and affiliate programs and less directly with just frequent travel. This doesn’t mean that members are less valuable, as they could have different travel patterns and fill seasonal dips or weak demand periods, but this trend does indicate that the base of loyalty members contributed fewer nights than they did in 2016.

Liability

From the brand perspective, loyalty program liability per member, which is the average dollar value each member has accrued in unredeemed points, ended 2023 at 87 percent of the pre-pandemic levels. Loyalty point redemption revenues increased by 11 percent last year to $1.1 billion from $982 million in 2022. This could indicate that more points were redeemed to book rooms in 2023; however, it could also be due to the 4 percent rise in ADR or the devaluation of loyalty points needed to earn a free night.

Costs

The corporate costs incurred to maintain loyalty programs are paid for by fees charged to the hotels in the system. Per the 11th edition of the Uniform System of Accounts for the Lodging Industry (USALI), guest loyalty program fees include “any costs associated with programs designed to build guest loyalty to the property or brand.” To gain a better understanding of recent trends in guest loyalty program fees, CBRE analyzed the loyalty program fee payments made by 4,454 U.S. hotels in our Trends in the Hotel Industry database from 2022 to 2023. In 2023, these hotels averaged 215 rooms and achieved a 69.3 percent occupancy with a $211.44 ADR.

In 2023, guest loyalty program fees averaged 1.5 percent of total operating revenue, a ratio that was greatest at upper-midscale (2 percent), upscale (1.6 percent), and upper-upscale hotels (1.6 percent). Loyalty fees as a percent of total operating revenue was lowest at economy (.3 percent) and midscale (.9 percent) properties. To some degree, this metric serves as a proxy for the chain scales that benefit most from guest loyalty members staying (for pay) at hotels and earning points. In general, loyalty program members travel most frequently for conventions and business, explaining the bias toward the higher priced chain scales. Since loyalty program fees are charged as a percent of revenue earned, it is not surprising that fees on a dollar-per-occupied-room (POR) basis are greatest at luxury and upper-upscale hotels, and lowest at midscale and economy hotels.

Guest loyalty program fees are typically charged as a percent of the total revenue earned when loyalty program members pay to stay at a hotel and earn points. Therefore, with loyalty program fees growing at a greater pace than total operating revenue, it can be assumed that loyalty program members represent an increasing percentage of paying guests year over year.

From 2022 to 2023, total operating revenue at the CBRE sample increased by 8.8 percent, while guest loyalty program fees paid grew by 17 percent. The greatest difference between revenue and loyalty program fee growth was observed in the upscale, economy, and upper-midscale segments.

For our Trends survey, CBRE captures four different franchise-related fees on a discrete basis: royalty fees, marketing assessments, reservation fees, and guest loyalty program fees. From 2022 to 2023, the 17 percent increase in loyalty fees was greatest among the four components, while each of the three other components increased by less than 10 percent in 2023. The magnitude of the difference in year-over-year change confirms that loyalty program members are comprising a growing percentage of paid guests. It can be assumed that the hotel companies will increase the costs of all four franchise-related fees, so extraordinary growth in guest loyalty fees paid must be attributable to an increase in the number of loyalty guest stays.

Cost Transparency

Besides the guest loyalty program fees, hotel owners are also responsible to pay for the extra amenities and services provided to loyalty program members during their stays. Such costs may include complimentary food and beverage, upgraded rooms and housekeeping services, points provided as compensation for service failures, and access to an exclusive executive lounge.

To provide hotel owners and operators with greater insights into these costs, the 12th edition of USALI includes new loyalty program expense categories within the rooms, administrative and general, and sales and marketing departments. CBRE will begin to benchmark these additional costs in 2026 as the new USALI is adopted by the industry.