After hitting record lows during early points of the pandemic, last year finally presented long-awaited profitability returns for the U.S. hotel industry. Strong demand, coupled with strong pricing power in an inflationary environment, pushed revenues and profits beyond 2019 levels. By year’s end, total revenue per available room (TRevPAR) reached $202.23, and gross operating profit per available room (GOPPAR) was $73.70 with a healthy margin of more than 36 percent over 12 months.

This year opened with weak food & beverage revenues in January as well as growing labor costs that started to pressure margins even as revenue and total profits were improved from 2019. February, however, produced a positive turn when industry GOPPAR increased 54 percent month over month to $77.37.

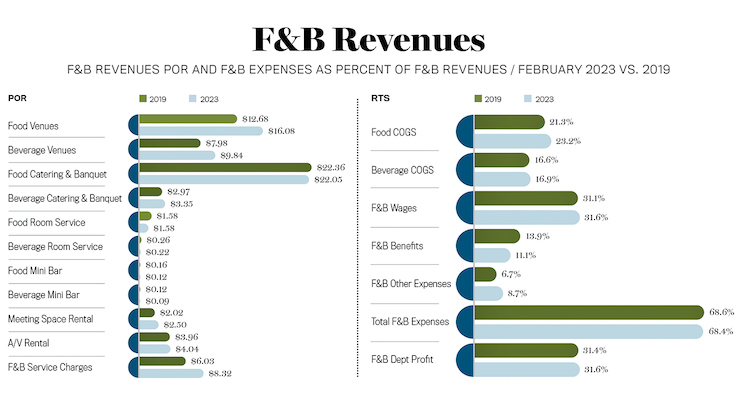

Groups and events are returning, which was evident in February’s F&B metrics. On a per-occupied-room (POR) basis, nearly all F&B revenues outpaced their 2019 levels, including catering and banquets revenues, which have lagged while group demand has struggled to rebound. Other F&B revenues also did well in February, indexing above 2019 levels. Inclusive of revenues associated with groups and events, the data demonstrates that while revenues are returning, hoteliers are still managing their costs well, particularly in areas where savings are available such as F&B labor costs (specifically benefits). The industry has seen a change in labor structure with contract labor producing savings within benefits expenses. Overall, February’s F&B expenses as a ratio to sales were on par with their 2019 comparable, despite a slight increase in food costs and other expenses. As a result, F&B profit margins were able to slightly beat their 2019 levels.

Overall labor costs are steadily increasing as well, with total labor costs per available room (PAR) up nearly 3 percent from their 2019 level. For the six months leading to February 2023, total labor costs per available room (LPAR) exceeded 2019 levels. This has certainly impacted profit margins, although not proportionately. Limited-service hotels, which typically see higher margins, have not recovered to their pre-pandemic levels as much as full service due to the impact of increasing labor costs that bare heavier weight on the bottom line.

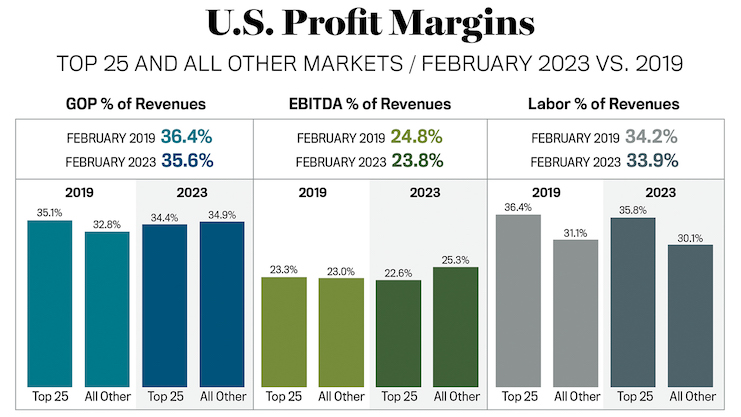

Throughout 2022, the U.S. Top 25 Markets showed monthly improvements in both GOP margin and GOPPAR. By December, more than 25 percent of the top markets had recovered GOPPAR above 2019 levels. February 2023 continued to demonstrate that improvement with 44 percent of top markets indexing above 2019 GOPPAR, and GOPPAR overall was 1.6 percent higher than 2019 levels. GOP margin is now within 1 percentage point of catching up to 2019 levels.

All other markets beat the aggregate of the Top 25 Markets in both profit margins (GOP and EBITDA) in February. These markets, still riding the wave of strong demand and rates throughout the pandemic, are generally known to have lower labor costs as compared to the top markets, ultimately resulting in higher profit margins.

This dynamic will be one to watch throughout 2023 as labor costs are expected to continue to grow and as STR/Tourism Economics forecast little growth in both ADR and occupancy. Gross operating profit is expected to continue to exceed 2019 levels in 2023; however, when taking into account inflation, GOP is not projected to index above 2019 levels.