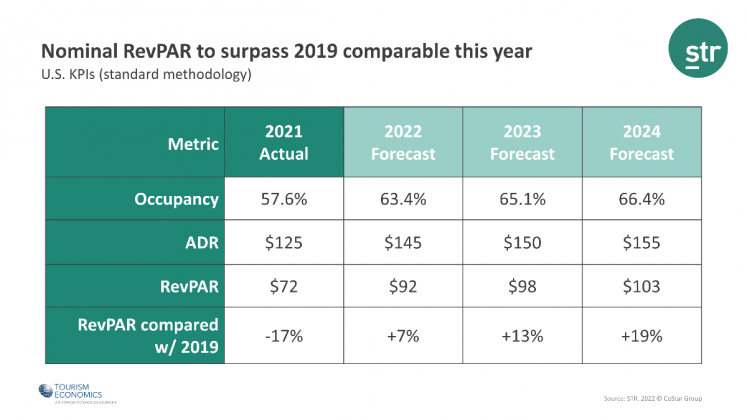

NEW YORK—STR and Tourism Economics have upgraded the recovery timeline for U.S. hotel revenue per available room (RevPAR). On a nominal basis, the metric is now expected to surpass 2019 levels in 2022, according to the latest forecast just presented at the 44th Annual NYU International Hospitality Industry Investment Conference.

The major factor in the revised timeline was a +$11 adjustment in 2022 average daily rate (ADR). Occupancy for the year is projected to come in under the pre-pandemic comparable, while ADR and RevPAR are forecasted at $14 and $6 higher than 2019, respectively. Previous versions of the forecast projected nominal RevPAR recovery in 2023.

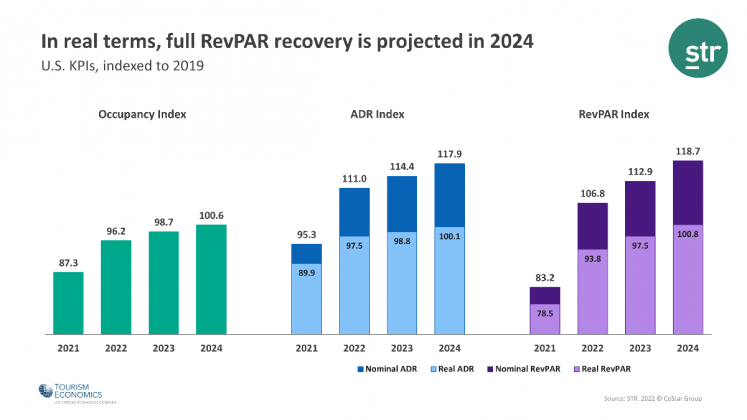

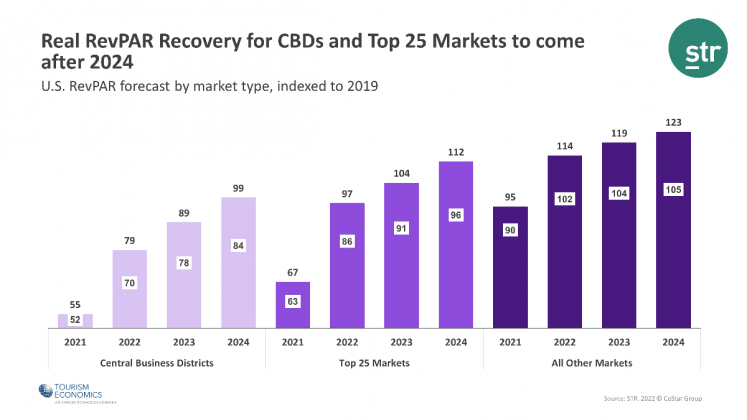

When adjusted for inflation, full recovery of ADR and RevPAR are not projected until 2024. Central business districts and the Top 25 Markets are not expected to reach full RevPAR recovery until after 2024.

“Demand and occupancy have trended well in line with our recent forecasts, but pricing continues to exceed expectations due to the influence of inflation as well as the economic fundamentals supporting increased guest spending,” said Amanda Hite, STR’s president. “This latest forecast acknowledges the risk of a light recession with no anticipation of mass layoffs and household finances in a strong position to mitigate recession impacts. The traveling public is less affected by recession, and right now, we are forecasting demand to reach historic levels in 2023 as business travel recovery has ramped up and joined the incredible demand from the leisure sector. Of course, while the top-line metrics are set to reach full recovery on a nominal basis, we must recognize that profitability has only started hitting 2019 levels recently. Concerns persist around the cost of labor and services, and hotels in some major markets are still well behind in the recovery timeline. Our forecast revision next quarter will reflect any visible impact from recent Fed decisions on interest rates.”

“The outlook for hotel performance remains positive,” said Aran Ryan, director of lodging analytics at Tourism Economics. “Even as the economy faces headwinds of higher interest rates, volatile financial markets, and inflation, lodging demand and room rates are being buoyed by strong household finances and the return of business travel.”

“With the Federal Reserve rapidly tightening monetary policy to tame inflation, there is a risk that financial conditions, which remain very accommodative, start to tighten in a disorderly manner,” said Adam Sacks, Tourism Economics president. “This would risk abruptly slowing the flow of credit and weigh on corporate and business confidence, which would further restrain economic growth. Should a U.S. recession occur, it is anticipated to be less severe than the Great Financial Crisis, due to lower current overhang of financial imbalances. Elevated savings buffers among consumers, particularly those of higher income households, would also help mitigate the impact of a downturn to sectors such as lodging.”