STR’s newly launched monthly profit and loss program examines COVID-19’s effect on March 2020 U.S. hotel profitability (or lack thereof). This pandemic has significantly impacted the hotel industry, forcing thousands of hotels in the United States to close their doors in response to lockdown measures and decreases in demand. The March data reveals that not all hotels were hit equally, and certain product types may be better positioned to weather the downturn.

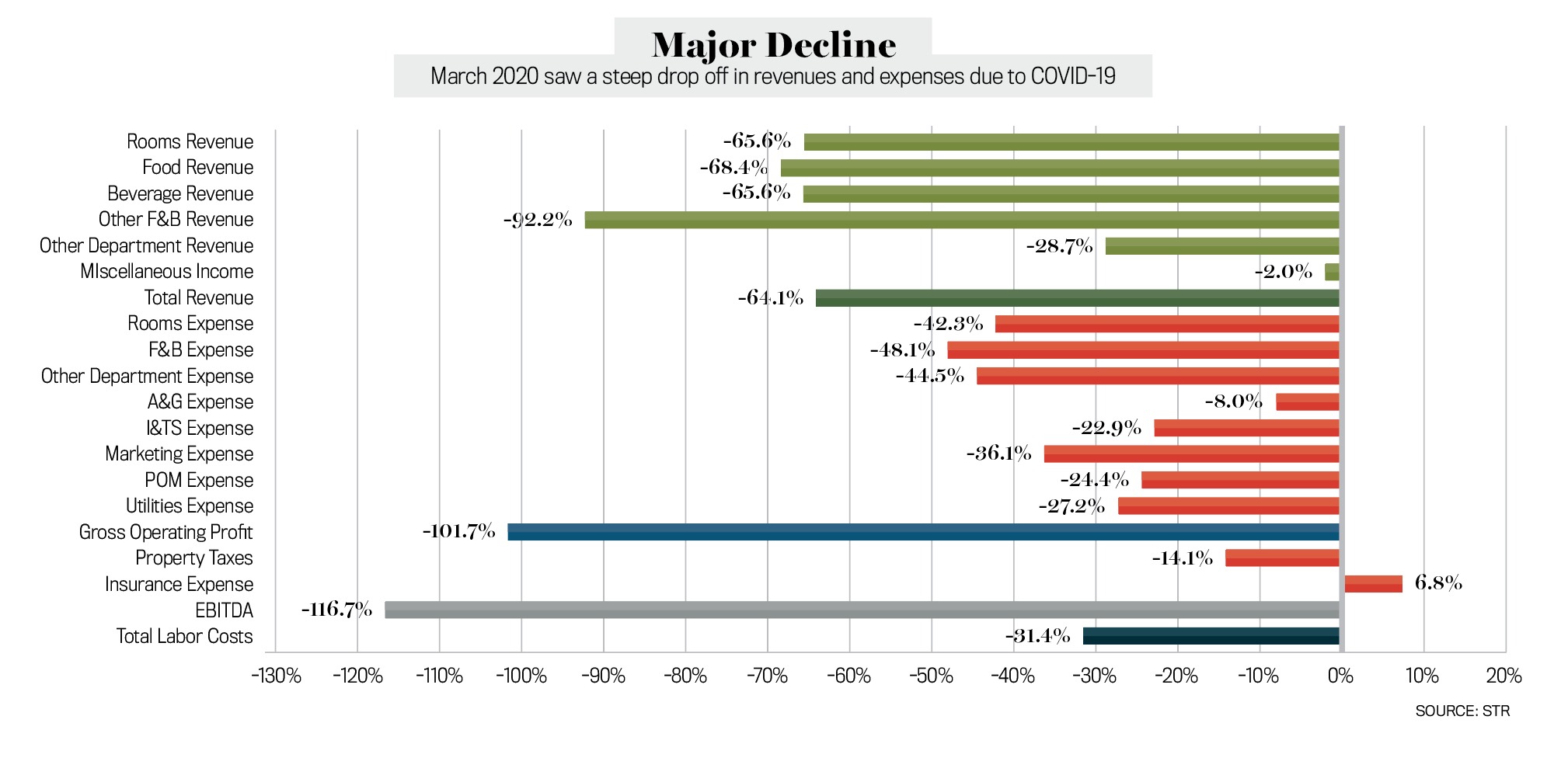

Total revenues declined 64.1 percent when comparing March 2020 to 2019, and total revenue per available room (TRevPAR) declined from $291.83 to $104.93. Although all sources of revenue decreased as occupancy dropped to record lows, some of the largest declines were attributed to food and beverage losses. Group demand among luxury and upper-upscale hotels plummeted 67.3 percent. Loss of group travel resulted heavily in loss of F&B revenues, specifically, other F&B revenues, which include revenues associated with meeting room rentals and related service charges, which dropped 92.2 percent.

Hotels adjusted in response to rapid declines in demand, reducing staff levels and other variable expenses as much as possible. Rooms, F&B, and other department expenses each declined more than 42 percent, and total labor costs dropped more than 31 percent. Despite these reductions, expenses of a more fixed nature could not be reduced as sharply, producing a greater impact to the profit loss hotels saw in March.

Gross operating profit per available room (GOPPAR) was down 101.7 percent to negative $2.10. In other words, in March, hotels took a loss of over $2 per available room night. Gross operating profit margin declined to negative 2 percent. To put the severity of this loss into context, hotels posted a March 2019 GOP margin of 42 percent. After deducting management fees, rent, insurance, and other fixed charges, the result is a 116.7 percent decline in earnings before interest, taxes, depreciation, and amortization (EBITDA).

While all hotels have suffered financially during this time, limited-service hotels fared better at the beginning of the pandemic than full-service hotels, showing a 51.9 percent decrease in TRevPAR compared with a 64.5 percent for full-service. These decreases correlate directly with profitability decreases, resulting in a 79.8 percent drop in GOPPAR for limited-service hotels, while full-service hotels experienced declines worse than 103 percent.

Lastly, the March data shows that the most impacted hotels from a location perspective are located in urban and airport locations. Additionally, hotels felt the loss of international travel demand with the travel bans put in place beginning in mid-March. Hotels in airport locations saw significant declines in profitability during the month. Alternatively, hotels in interstate locations fared the best of the worst. Essential workers and those traveling to new quarantine locations resulted in minimal demand, resulting in TRevPAR decreases of approximately 32 percent, unlike urban locations, which saw a 67.4 percent decline.

Although March profitability saw steep declines, weekly occupancy results from April and early May have shown slight improvements. As shelter-in-place orders start to lift, the data shows that a rebound is on its way as demand slowly increases, driving revenue, which ultimately leads towards profitability.