In lodging industry parlance, other operated departments are frequently referred to as minor operated departments. Based on recent trends in other operated department revenues and profits, these sources of income have become less consequential to both the top and bottom lines of U.S. hotels.

Other operated departments consist of revenue-generating services provided by the hotel wherein the vast majority of the costs, operational responsibility, and financial risk for providing these services are assumed by the hotel. Examples of other operated departments include gift shops, golf courses, spas, and parking lots.

The recovery of the U.S. lodging industry since the depths of the 2008/2009 recession has been strong. From 2010 through 2016, rooms revenue for the properties that participate in our firm’s annual Trends in the Hotel Industry survey increased by 38.8 percent, while total hotel revenue grew by 39.8 percent. But, during this same period, the revenue generated by the other operated departments increased by just 15.8 percent.

Other operated departments have always been a relatively minor source of revenue for most hotels. In 2016, other operated department revenue for our Trends sample averaged 4.3 percent of total revenue. With other operated department revenue growing at a slower pace than total hotel revenue, this ratio is down from 5.2 percent in 2010.

Other operated departments are more meaningful at resort hotels that have multiple recreational and retail outlets. At these property types, other operated revenues averaged 10.1 percent of total revenue in 2016. At limited-service hotels that simply offer movie rental or guest laundry services, other operated department revenues average just 1.4 percent of total revenue.

The following describes recent trends in revenues, expenses, and profits for five other operated departments. In all circumstances, these data come from revenue-generating sources that meet the Uniform System of Accounts for the Lodging Industry standards to be classified as Other Operated Departments, as opposed to Miscellaneous Income.

On the Decline

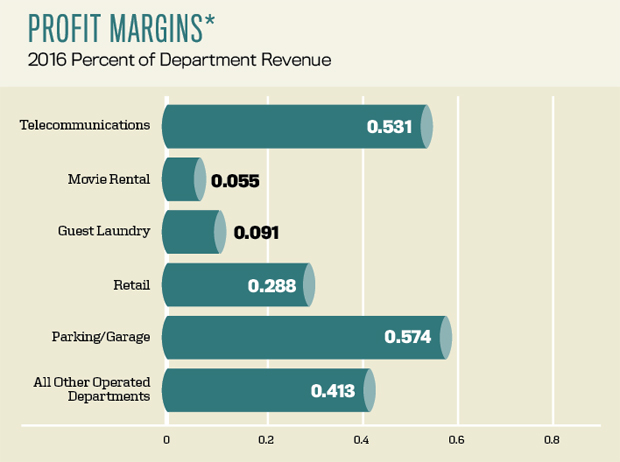

Despite the increase in occupancy from 2010 to 2016, it is no surprise that the revenues hotels receive for telecommunications and movie rentals continued to decline during the past seven years. Because of the increased use of smartphones and tablets for communication and entertainment, revenues from telecommunications declined by 52.7 percent during the period 2010 to 2016, while movie rental sales dropped by 52.9 percent.

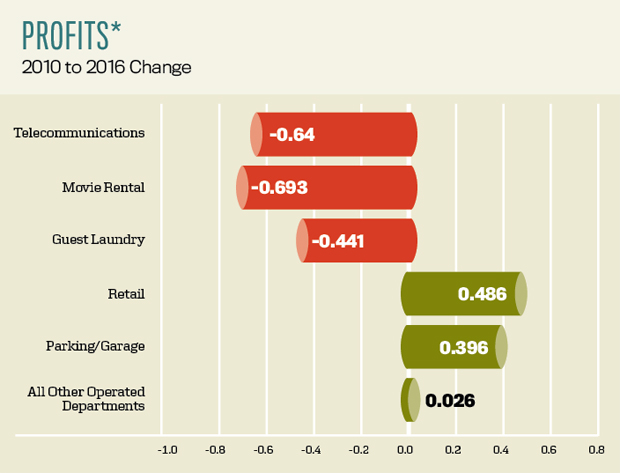

Since the sole expenses associated with these revenue sources are the telephone and movie rental costs charged by the respective service providers, it makes sense that we have observed commensurate declines in the expenses within these two departments. Unfortunately, the expense cuts were not sufficient to prevent declines in profitability. From 2010 to 2016, profits fell by 64 percent within the telecommunications department, and 69.3 percent for movie rentals.

Just as cell phones have had a negative impact on telecommunications revenue, the proliferation of casual business attire has reduced the revenue hotels receive from providing guest laundry and valet services. From 2010 to 2016, the revenue received from guest laundry has declined by 14.1 percent, while the profits this department generates have fallen by 44.1 percent.

On the Upswing

Not all other operated departments are on the decline. U.S. hotels have enjoyed increased revenues and profits from some sources that have either evolved or been dormant.

The face of retail offerings has changed significantly at most U.S. hotels. The traditional “newsstand” that was either leased out or operated at a loss has been replaced with front-desk kiosks that sell newspapers, toiletries, snacks, soft drinks, and microwavable foods.

Further, these kiosks are now appearing in limited and select-service properties that historically did not offer any retail services to their guests. Additionally, readers should note that the new grab-and-go concepts that have replaced food and beverage revenues are not considered retail operations within other operated departments. Their revenues and expenses are recorded within the food and beverage department.

From 2010 to 2016, the revenues generated by hotel retail outlets increased by 17 percent. Because of the changing nature of the products offered, as well as the staffing of the kiosks by front desk personnel (whose costs get recorded in the rooms department), the department expenses to run retail operations have increased by just 11.3 percent. The net result has been a 48.6 percent boost in retail department profits during the past seven years.

Since 2010, hoteliers have found parking operations and garages to be a lucrative source of income. Accordingly, parking revenue has increased by 28.7 percent from 2010 to 2016. For those hotels that charge for parking, revenues equaled 2.5 percent of total revenue in 2016. Since parking is a relatively high margin operation, the profits from parking operations have risen by 39.6 percent over the past seven years.

Additional Revenues Needed

With RevPAR forecast to grow less than 3 percent on an annual basis through 2021, hotel owners and operators are looking for other sources of revenue to bolster the top line. Hoteliers are challenged to develop new, or expand existing, other operated departments that offer the services today’s guests demand and value. Concurrently, owners and operators need to eliminate, downsize, or adjust those other operated departments that no longer meet guest needs.

About the Author

Robert Mandelbaum is Director of Research Information Services for CBRE Hotels’ Americas Research. To benchmark the performance of your hotel’s other operated departments, please visit pip.cbrehotels.com, or call (855) 223-1200.

Top photo: The Marketplace at the Crowne Plaza Atlanta-Midtown