Many independent hoteliers will cop to considering what it would be like to convert their hotels into chain-affiliated properties. With this common musing comes this question: How do independent hotels compare to their chain-affiliated brethren?

In the United States, full-service (FS) independent properties account for 34.4 percent of all FS hotels, representing 447,379 rooms. Looking at trailing 12-month data from April 2018, FS independent properties have had an average occupancy of 67 percent and an average daily rate (ADR) of $191. To compare, FS chain-affiliated hotels have had an average occupancy of 74.1 percent and rates averaging $174.

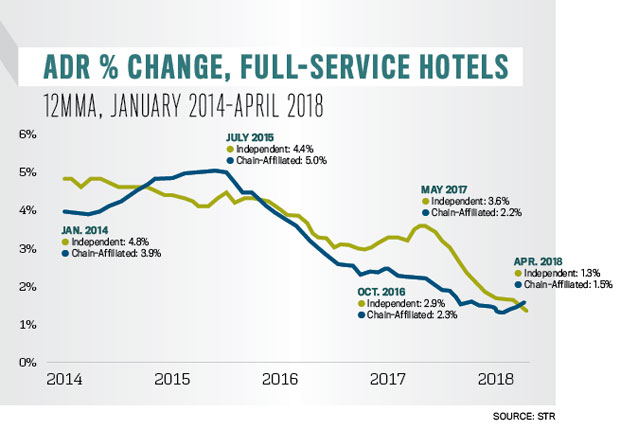

When analyzing demand data back to 2014, demand growth for FS independent hotels has been slower than for FS chain-affiliated hotels. However, when looking at ADR, FS independents have had consistently higher rates since 2014 by an average of $15, and have had higher ADR growth rates—with the exception of November 2014 through October 2015—than FS chain-affiliated hotels. Over the past two years, the gap between ADR growth rates of these two types of hotels has continued to widen, where only in the most recent months have FS chain-affiliated hotels started to gain on FS independents.

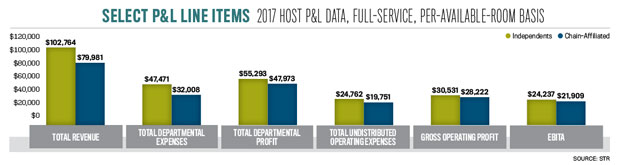

FS independents have been doing a great job of pushing rates, which translates to their bottom line. When looking at 2018 STR HOST P&L data for year-end 2017, FS independents bring in 28.5 percent more revenues than FS chain-affiliated hotels on a per-available-room (PAR) basis. Where FS independents really stand out is in food and beverage revenues, as well as other operated departments. With more hotels in resort locations, FS independents are able to bring in 54.1 percent more food and beverage revenues and 139 percent more other operated revenues PAR than chain-affiliated hotels. When looking at the bottom line, FS independents bring in $30,531 PAR in gross operating profit versus only $28,222 for FS chain-affiliated hotels.

On the other side of the coin for FS independents, total departmental expenses account for 46.2 percent of total revenues, and total undistributed operating expenses account for 24.1 percent of total revenues. Total departmental expenses for independents are 48.3 percent higher than for FS chain-affiliated hotels on a PAR basis, where most of the higher expense comes from the food and beverage department. When looking at undistributed operating expenses, the two largest expenses for both FS independents and FS chain-affiliated hotels are the administrative and general and marketing departments. However, these expenses are 59.6 percent and 9 percent more for FS independents, perhaps due to the lack of centralized services of FS independents or the fact that there are additional cost savings when part of a brand.

So, while FS independent hotels do have slightly lower demand than FS chain-affiliated hotels, they tend to have higher profits on a PAR basis, driven by higher revenues from pushing rates, which boost their bottom line. However, while independents have higher absolute profits, chain-affiliated hotels are seeing higher profit margins. So, even with the data comparison of these two types of hotels, independent hotel owners will need to do a lot of digging if they truly are considering a switch.

About the Author

Raquel Ortiz is the Assistant Director of Financial Performance at STR.