When investing in hotels, two of the metrics most frequently evaluated are recent year-over-year trends in revenues and profits, as well as current performance values. Investors need to balance the current levels of a property’s occupancy, average daily rates (ADR), revenues, and profits, with the recent direction of the changes in these measurements. Some people prefer to invest in hotels that are currently achieving low levels of revenue and profit in an attempt to time the market, but are coming out of the bottom of the cycle and achieving strong gains on the top and bottom lines. Others prefer hotels that are approaching or are achieving peak levels of performance.

When analyzing the performance of the extended-stay hotel segment, we see a difference in the performance of the upper-priced properties in this segment versus the moderate-priced properties. Since 2010, moderate-priced extended-stay hotels have shown greater gains in revenues and profits. However, upper-priced extended-stay hotels continue to achieve premiums in occupancy, ADR, revenues, and profits.

To evaluate the performance of extended-stay hotels in the U.S., we analyzed operating data for a sample of 360 upper- and moderate-priced properties that submitted data each year from 2010 through 2017 to CBRE’s annual Trends in the Hotel Industry survey. For this analysis, the upper-priced sample consisted of hotels affiliated with extended-stay brands in the upscale segment. Moderate-priced extended-stay hotels are affiliated with brands in the upper-midscale and midscale segments. Economy extended-stay hotels were excluded from this analysis to avoid a significant bias in the sample. Estimates of 2017 performance (2017E) were made based on the preliminary results of our 2018 Trends survey.

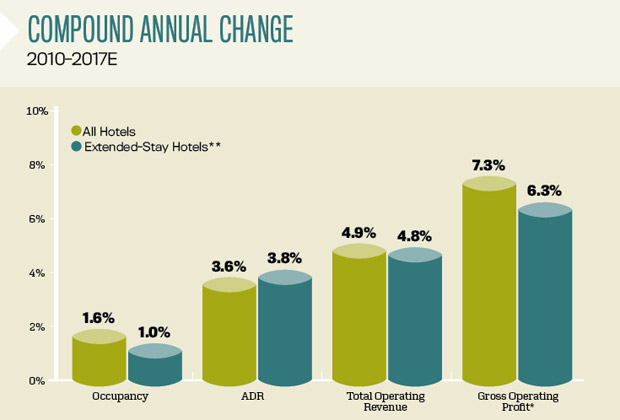

In aggregate, the properties in the extended-stay sample achieved compound annual growth rates (CAGR) of 4.8 percent in total operating revenue and 6.3 percent in gross operating profits (GOP) from 2010 through 2017E. While strong, these growth rates are less than the 4.9 percent CAGR in revenue and 7.3 percent CAGR in profits achieved by the entire Trends survey sample inclusive of all property types.

During the depths of the 2009 industry recession, extended-stay hotels suffered significant double-digit declines in revenues and profits, but not to the same extent as the overall U.S. lodging industry. This helps to partially explain the relatively lower growth rates in performance for the extended-stay sample, compared to all U.S. hotels during the study period.

Despite the slower historical growth rates, it is estimated that the extended-stay sample will continue to achieve significant premiums in both occupancy and profit margins compared to the overall Trends sample. By capturing demand for five or more days, not only are occupancy premiums achieved, but so, too, are operational efficiencies. Fewer check-ins and check-outs, limited levels of housekeeping services, and a lack of retail food and beverage all lead to the 50.1 percent GOP margin estimated for the extended-stay hotel sample in 2017.

Comparative Changes

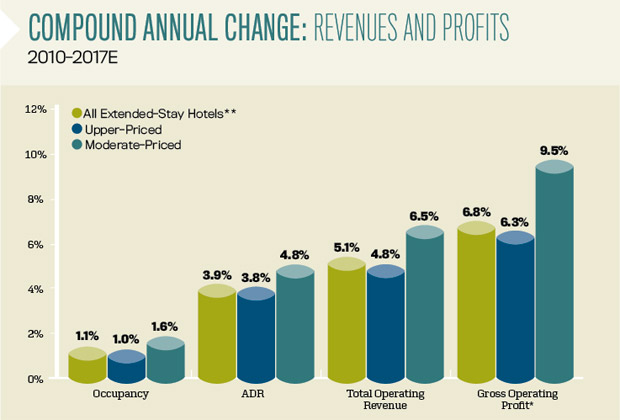

Just as we observed differences between the historical performance of extended-stay hotels versus all other property types, we have also seen operating differences between upper-priced and moderate-priced extended-stay hotels.

Compared to upper-priced extended-stay hotels, the moderate-priced extended-stay sample achieved greater CAGR gains in all major hotel performance metrics since 2010. Greater revenue growth (6.5 percent CAGR) led to superior increases in profits (9.5 percent CAGR) at the moderate-priced properties compared to the upper-priced properties. The bulk of the enhanced revenue and profit growth occurred during 2013 and 2014, when occupancy levels at the moderate-priced properties grew by a combined 15.8 percent.

Also contributing to the superior profit growth for the moderate-priced properties was greater control over expenses. From 2010 to 2017E, labor costs per-occupied-room at the moderate-priced sample grew by a CAGR of 1.7 percent, compared to 2.6 percent for the upper-priced sample. Moderate-priced extended-stay hotels operate on very limited staffing levels, and typically offer housekeeping services just once a week. Being mostly fixed in nature, labor costs at the moderate-priced extended-stay hotels do not necessarily react in sync with fluctuations in occupancy.

While the moderate-priced properties have experienced greater performance growth rates over the past seven years, the upper-priced extended-stay hotels are estimated to have achieved operating premiums in 2017. During the year, occupancy for the upper-priced sample is estimated to have been 80.9 percent. This is greater than the estimated 78.6 percent annual occupancy rate for the moderate-priced sample.

By achieving a 62 percent premium in ADR ($146.84 vs. $90.56), the upper-priced properties in the sample were able to achieve a 69 premium in total operating revenue per available room (PAR) during 2017E. The increased revenue also led to a 72.9 percent enhancement in GOP PAR ($22,408 vs. $12,959).

Accounting for the inherent differences in dollars PAR, upper-priced extended-stay hotels also achieved a premium in profit margin. In 2017E, the upper-priced sample achieved an estimated GOP margin of 50.3 percent of total operating revenue. This compares favorably to the 49.2 percent GOP margin at the moderate-priced properties. While staffing levels are lower at the moderate-priced properties, the higher revenue levels at the upper-priced properties cover the greater labor costs and result in a labor cost ratio 0.5 percent less than the moderate-priced sample.

Healthy Future

In the March 2018 edition of Hotel Horizons, CBRE forecast the demand for U.S. hotels to increase by approximately 2 percent each year through 2022. This implies that economic indicators such as income and employment will continue to remain healthy and generate lodging demand. Given the corporate orientation of most extended-stay demand, this bodes well for the extended-stay lodging segment.

About the Author

Robert Mandelbaum is Director of Research Information Services for CBRE Hotels’ Americas Research.