The latest edition of the Pulse Report, which compares data from November 2021 with October 2021, shows that cancelation activity has increased over the last few weeks as concerns about the new COVID-19 variant, Omicron, gather pace. Despite this, impressive activity was recorded over Thanksgiving in the United States. The appetite for travel is still very much present, and web searches for travel in North America and Latin America remain high.

“We aggregated user forecasts for hotels running on Duetto to glean some insights for the balance of 2021,” said Lloyd Biddle, director of enterprise solutions, Duetto. “We found that a period of stability, after a record summer travel period, and before seasonal winter lows, concluded with an outstanding Thanksgiving holiday.”

Latin America

LATAM is well ahead of other global regions in terms of booking pace, with an increase of 60 percent from the last Pulse Report, and web search activity is again high for short-term booking windows, as well as for 2022 as a whole. The data also shows that in terms of asset classes, the biggest winners for pick up in the region were traditional hotels and short-term rentals, both reporting triple-digit gains.

It’s a two-sided story regarding on-the-books for LATAM with OTB committed occupancy trending higher in each of the next five months but dropping behind the previous year from May 2022 onwards.

Web traffic across Latin America was again healthy in the short-term booking window, as well as the full year 2022, with resorts attracting the most attention, closely followed by all-inclusive properties.

North America

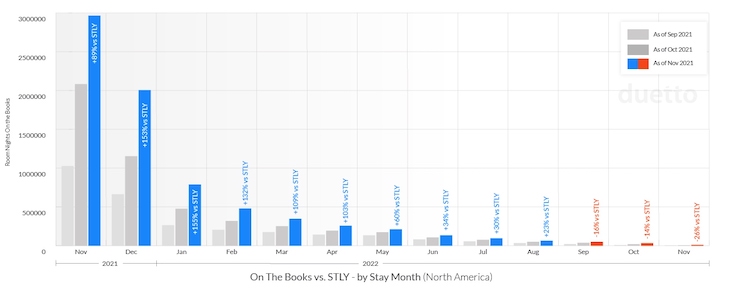

Pick up in North America showed some real positivity for December but dropped for Q2 and Q3 of 2022. However, on-the-books committed occupancy, transient reservations, and group blocks remain very healthy, and web traffic shows that consumer interest in travel across the United States remains reassuringly high with a 97 percent increase for arrival dates throughout 2022.

In terms of which accommodation types are performing well at the moment, the data shows that in North America casino properties were at the top of the wish list, as well as extended stay properties, while outdoor recreation and ski asset classes have subsided a little.

Looking at cancelations, there was an increase of 25 percent for December stay dates and 50 percent for those in January.

Biddle adds, “As we all enthusiastically look forward to a promising New Year, the forward-looking booking data predicts that while reservation cancelation activity has increased in recent weeks, which is not surprising considering the uncertainty around the two prevalent COVID-19 variants, consumer interest in travel experiences is not waning as evidenced by high volumes of availability, and price shopping on brand.com websites for stay dates throughout 2022. The velocity of bookings for travel in the New Year is also holding up well, especially in Latin America where the strong booking pace has resulted in pricing power and high average rate growth.”

Asset Classes

The Pulse Report has recently started looking at the data in terms of accommodation types to ascertain how different asset classes are faring.

Biddle says, “Today, most hospitality companies consist of a diverse portfolio of accommodation types. This is not a new phenomenon as the popularity of different asset classes accelerated during the pandemic. Brand proliferation into different niche market segments and the exploding popularity of short-term rentals has many of us rethinking what lodging means today.”

“All-inclusive resorts and casinos cater to a wider array of customer segments than ever before. Hostels have long been popular throughout Europe. Outdoor recreation was all the rage during the pandemic. If anyone remembers the term condo-hotels or condotels, this mixed-use asset class is prevalent in development pipelines across the United States, and apartment hotels are commonplace across Europe and Asia Pacific. By typing the term ‘space hotels’ into a search engine will show you that we may be introducing another new asset class as soon as the year 2026. It’s clear the hospitality industry is rapidly changing,” Biddle adds.

In terms of how various asset classes are performing in the United States, the latest Pulse Report data shows that new bookings for casino resorts and extended stay rose while outdoor recreation and ski resorts subsided. For OTB, ski lodging and resorts lead other accommodation types for the full year 2022. And casinos led the way in terms of online shopping for stay dates in 2022.

The Duetto Pulse Report is a quarterly report available for free to hoteliers from around the world. It tracks key metrics for North America, Latin America, EMEA, and APAC.