While there are still many unknowns regarding the economy, STR’s data points to further stabilization for the U.S. hotel industry. Aligned with record highs in ADR and RevPAR, total revenues and profits were strong in 2023, well above 2022 and only slightly below 2019 levels. Total revenue per available room (TRevPAR) grew by 10 percent compared to 2022, and with a more normalized growth rate in total expenses per available room (up only $13 in 2023 versus $37 in 2022), gross operating profit per available room (GOPPAR) grew 8.2 percent, and EBITDA PAR increased 7.6 percent. However, profit margins were slightly lower than 2022 even with slowing growth in expenses. GOP margins ended the year at 35.9 percent, and EBITDA margins were 25.1 percent, both 0.4 percentage points lower than 2022.

Labor Costs

While all expenses have been growing for hotels, labor is having the greatest impact. Labor margins were an average of 3.4 percentage points higher than all other expense margins, while labor on a per-occupied-room (LPOR) basis was up 8.7 percent year over year and up 11.6 percent from 2019. One positive is that while labor costs did continue to grow, the LPAR monthly growth rate through 2023 slowed to only 0.4 percent, which shows that although hospitality labor remains competitive, cost growth is stabilizing.

Because of the lower need for labor, hotels in the extended-stay and select-service segments continue to be popular—and with good reason. GOP margins for these three types of hotels remain well over 40 percent and only two percentage points or less than peak margins in 2019.

Group Demand

Group business will be important to continue growing overall demand in the hotel industry, as recovery for this segment fell short of previous levels, with group F&B revenues up 10.6 percent compared to last year. A typical trend, the F&B department has the highest labor expense POR for those classes in the group segment. However, the gap between rooms and F&B labor is typically larger. In 2019, F&B labor POR was $14 higher than rooms labor, but in 2023, the difference was only $12. This datum, paired with the higher price of labor today, continues to illustrate that group and convention business is still down. The Latest Projections

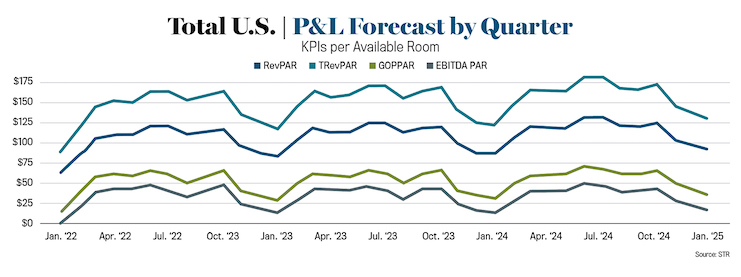

As we move into 2024, our forecast shows GOPPAR is set to increase because of improved TRevPAR and more stable labor costs. Luxury chains and upper upscale chains are projected to have the highest increases in LPAR, based on how group performance has been trending in the past year. TRevPAR projections for upper-upscale chains and upscale chains are strong as well, on the assumption that group demand will continue its growing trend. The biggest factors influencing the bottom line in 2024 will continue to be rising costs, especially labor, and the continued return of groups.