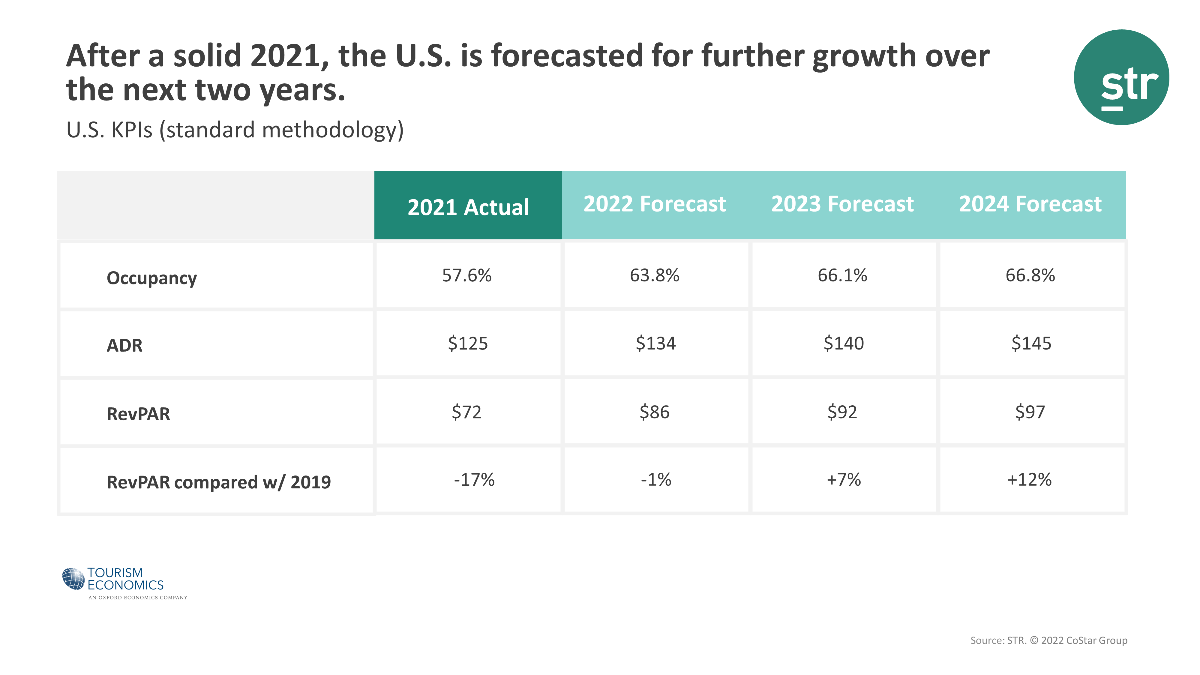

LOS ANGELES — Underpinned by continued strengthening in average daily rate (ADR), STR and Tourism Economics have slightly upgraded the U.S. hotel forecast, just released at the Americas Lodging Investment Summit (ALIS).

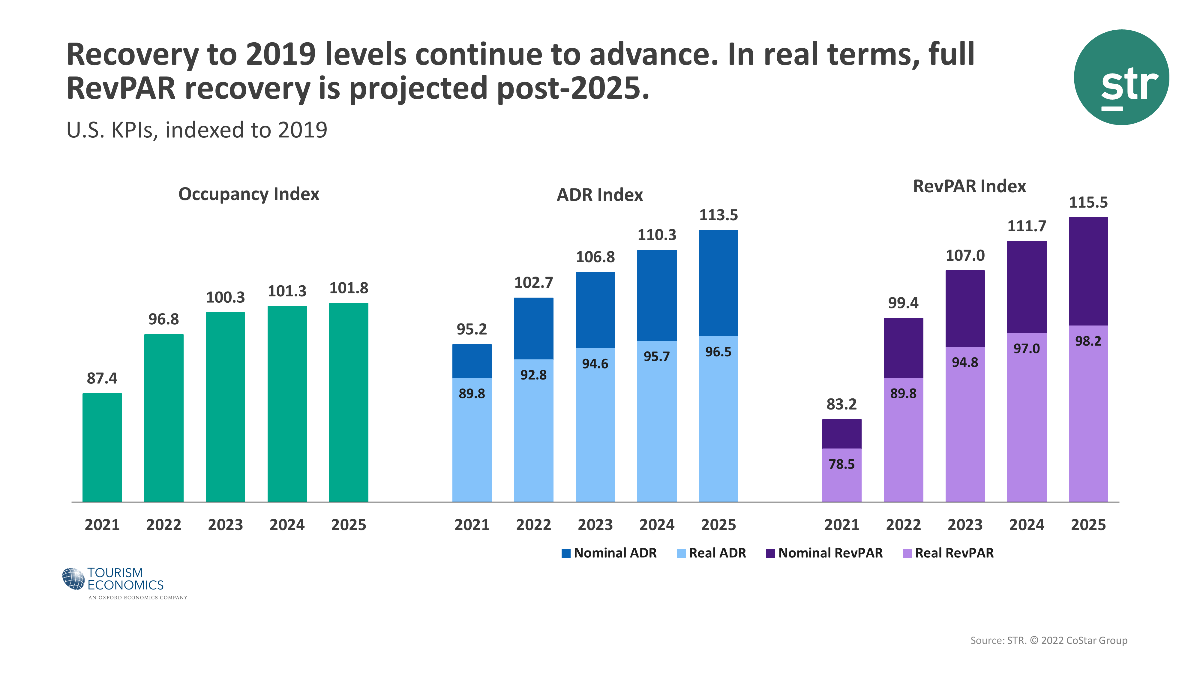

The timeline for recovery remains mostly the same as the previous version of the forecast released in November. On a nominal basis, ADR is expected to surpass the pre-pandemic comparable this year, while revenue per available room (RevPAR) is anticipated to exceed 2019 levels in 2023. When adjusted for inflation, however, full recovery of ADR and RevPAR are not projected until after 2025. Occupancy is projected to surpass 2019 levels in 2023.

“The industry recaptured 83 percent of pre-pandemic RevPAR levels in 2021, and momentum is expected to pick up after a slow start to this year,” said Carter Wilson, STR’s senior vice president of consulting. “With so much of that RevPAR recovery being led by leisure-driven ADR, however, it is important to keep an eye on the real versus the nominal. Terms of recovery are not playing out evenly across the board, and many hoteliers have had to raise rates to minimize the bottom-line hit from labor and supply shortages. We are anticipating inflation to remain higher throughout the first half of the year with a gradual leveling off during Q3 and Q4. If that happens, and we avoid major setbacks with the pandemic, this year will certainly be one to watch with demand and occupancy also shaping up to hit significant levels during the second half.”

“Looking beyond the first quarter, the backdrop for sustained travel recovery is strong,” said Aran Ryan, Tourism Economics director. “As the public health situation improves, sturdy labor market fundamentals, healthy consumer balance sheets, and continued business investment are anticipated to support further lodging demand growth and pricing gains.”