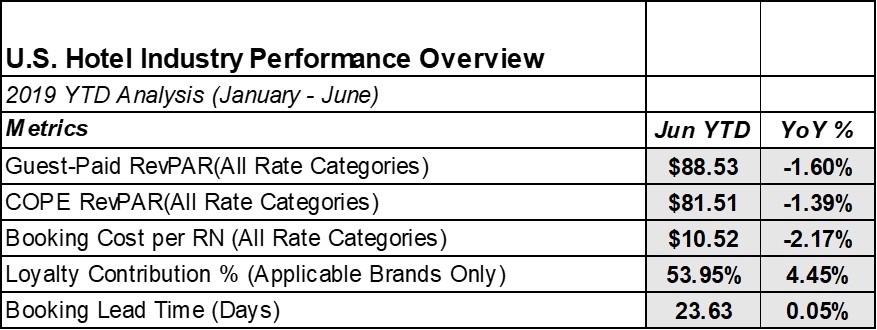

ROCKVILLE, MD – More than midway through 2019 it is a good time to reflect on the hotel industry’s performance so far this year. Year-to-date through June 2019, the percentage of total room nights booked by members of brand loyalty programs increased 4.4 percent year-over-year (YOY) to 53.9 percent of all room nights booked at hotel brands with existing loyalty programs, citing Kalibri Labs’ U.S. Hotel Industry Performance Overview (HIPO). When looking at bookings by source of business, Brand.com and OTA Bookings continued their dueling track meet, each with 6.6% YTD growth YOY.

Guest-Paid RevPAR and COPE RevPAR decreased 1.6 percent and 1.39 percent YOY, respectively, driven by occupancy declines of 1.9 percent YOY, and indicating only modest ADR growth. Nationally, Length of Stay decreased by 2.67 percent YOY, and each of the top 10 MSAs in the U.S. HIPO showed considerable declines in Length of Stay. Booking Lead Time held steady at 23.6 days across all markets, chain scales and channels.

“While it’s encouraging to see Guest Paid ADR hold steady, or even show modest growth in some chain scales,” says Mark Lomanno, partner and senior advisor at Kalibri Labs, “There is some concern or trepidation in the RevPAR figures based on declining occupancy and very modest ADR growth in most markets. Weakening industry fundamentals caused by the rapidly changing nature of today’s lodging industry will require focused attention over the latter half of 2019 and into 2020.”

The full details of the U.S. Hotel Industry Performance Overview are available at KalibriLabs.com. Additionally, Kalibri Labs now offers a new, complimentary Market Kalibration newsletter that provides a summary of U.S. hotel performance trends.

*Contribution to Operating Profit and Expense – Revenue per available room based on the total room revenue paid by guests, after transaction-specific direct reservation costs have been deducted (i.e.: retail commissions, wholesale commissions, channel costs, TA amenity costs, and loyalty investment).