When I first started out in hotel brokerage back in the late 1980s, the market was unsophisticated and had not adopted the fiduciary focus that was required to establish trust. Consequently, the term hotel “broker” had mostly a negative perception. However, over the past 35 years, many brokers have moved into the role of trusted advisors, who passionately make paramount their fiduciary responsibilities. As a trusted advisor, the broker adds significant value for owners in many different respects. In this article, I review the main qualities that sellers and buyers should look for when selecting an advisor.

The Long Game.

First and foremost, trusted advisors represent the owner’s interests completely, not their own. They play the “long game” and will tell you the truth even when it conflicts with their own short-term self-interest. If you have worked with a broker for years and they have never told you to hold rather than sell, you may want to consider the implications.

Honest Advice.

Trusted advisors tell you what they really think rather than what you want to hear. While it is important for brokers to sell with conviction, selecting a broker based solely on a high opinion of value may not result in the best outcome. Be wary of brokers who provide an unrealistically high potential sales price just so they can secure a listing.

Stay Away From Carrots & Sticks.

Trusted advisors don’t use a carrots-and-sticks approach. If you choose a broker with hopes to receive an “early look” on future deals, or because they’re offering you exclusive, “off market” deals, it’s highly likely that they’re using similar tactics when selling your assets. This approach is a double-edged sword. The advantage that worked for you on the buy side can—and often will—work against you on the sell side. Trusted advisors focus on their client’s best interest, and that means finding the best possible buyer from an appropriate audience regardless of implications for themselves.

Trust the Process.

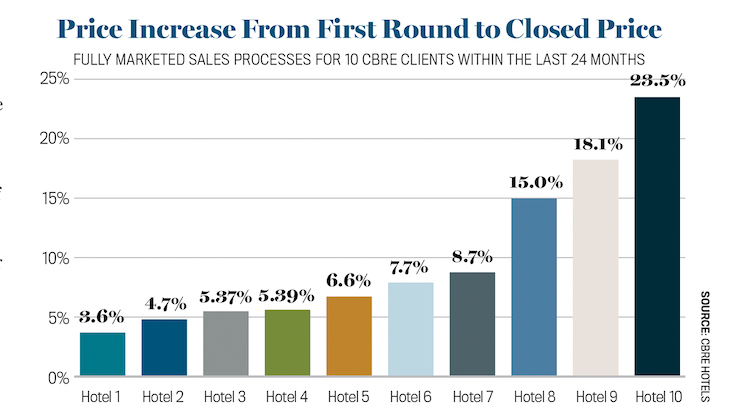

Trusted advisors know that direct deals frequently leave money on the table. Hotel buyers want off-market transactions for the simple reason that they usually benefit buyers. A well-run investment sales process creates competition and leverage for the seller, which provides the best available price, speed, and certainty from potential purchasers and invaluable leverage for the seller. This creates the right kind of discomfort from buyers who are forced to stretch to their maximum level of potential pricing and terms. Without a process, a seller is frequently leaving significant money on the table and will never know if a better deal was available. CBRE Hotels evaluated a representative set of 10 fully marketed institutional sales processes in the last 24 months and found the price increase by the ultimate buyer from the first round to the closing price averaged 9 percent per deal, resulting in aggregate incremental pricing of over $100 million to our clients (see chart below). This increase is just an example of what any experienced broker can achieve via a fully marketed institutional sales process.

Aligning Core Competencies.

Trusted advisors manage transaction processes for a living, while most owners focus on creating value for guests. This transaction skillset lets the advisor do what they do best, while the owner is more productive doing what they do best.

Eliminating Conflicts of Interest.

Every transaction has an inherent conflict of interests—the seller wants to sell high; the buyer wants to buy low. It is a direct conflict that a professional trusted advisor can mediate.

Defense Wins Championships.

Experienced advisors anticipate and mitigate challenges before they happen. Every hotel transaction has aspects that investors are likely to refute. A savvy advisor will identify investor predispositions and strategies and find data-driven mitigants to offset what will likely be used to lower price.