Considering an Omicron start to the year, the rise of inflation, and concerns around a recession ahead, it is remarkable that the U.S. hotel industry wrapped up 2022 with RevPAR almost fully recovered in real terms.

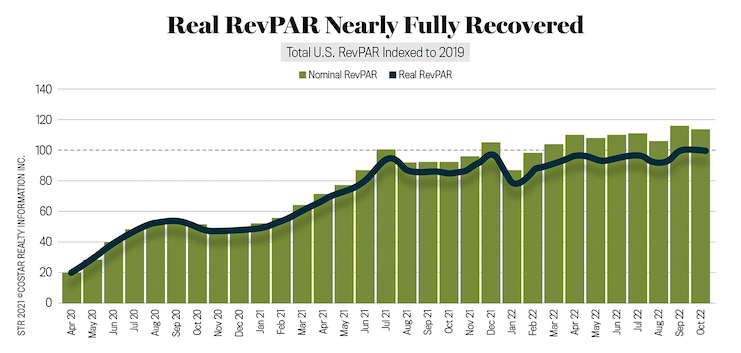

No matter the headwinds, U.S. consumers see travel as a birthright and continue to emphasize experiences with the pandemic now subsided. That has no doubt been key as the hotel industry once again displays its resilience. Nominal RevPAR (non-inflation adjusted) was 7 percent above 2019 levels late in the year. When adjusted for (real) inflation, RevPAR was matching pre-pandemic comparables.

That recovery, however, has not been even across the 166 STR-defined U.S. markets. An illustration of this recovery pattern has been seen in STR’s Market Recovery Monitor (MRM), which measures market-level performance against the appropriate pre-pandemic comparable from 2019. Markets are assigned to one of four categories based on RevPAR recovery to 2019: depression (RevPAR less than 50 percent recovered to 2019 levels), recession (RevPAR 50 percent to 80 percent recovered), recovery (almost recovered at RevPAR levels 90 percent or higher), and peak (100 percent plus recovered to 2019 levels). A small proportion of markets (16 percent) reached peak status as early as 2021—mainly those located in beach, mountain, and less urban locations. Florida markets also had a great 2021 due to an earlier “reopening.” Eight of the 166 U.S. markets, almost exclusively large urban markets, remained in depression in 2021, while a significant proportion of markets (36 percent) stayed in recession.

In 2022, all markets saw a shift up the recovery ladder. Larger city markets joined the recovery as group business improved and transient business travelers got back on the road. Meanwhile, consumers continued to travel for leisure and became more diversified in their destination choices, venturing back into city-centers and more populated destinations. In the 12-month period ending October 2022, 44 percent of U.S. markets were at peak, with real RevPAR above their 2019 values. Just over half (52 percent) of markets were in recovery, and 5 percent of markets remained in recession. The depression bucket was also empty at that point.

Recovery is even more pronounced when looking at the most recent 28-day real RevPAR, which, at the time of this writing, ended on Dec. 3, 2022. Over half (97) of all markets were at peak, posting real RevPAR above 2019. Sixty-five markets (39 percent) were in recovery, and only four markets (New Jersey Shore, Oakland, San Francisco, and San Jose) were in the recession category, with real RevPAR between 50 percent and 80 percent of what was seen in 2019.

The hotel industry made significant progress in 2022, with almost all markets recovering top-line performance by the end of the year. Gains were also made in profitability as the year progressed.

For 2023, the industry is navigating recessionary headwinds and a possible slowdown in consumer travel, but at the time of this writing (early December), STR and Tourism Economics forecasted all industry measures to be above 2019 comparables by early 2023. Total recovery of real (inflation-adjusted) ADR and RevPAR, however, is not expected until after 2024.