The U.S. hotel sector posted healthy performance growth during the first quarter of 2023 despite ongoing economic concerns presenting more hurdles for the leisure and business travel segments. However, as year-over-year growth slows against tougher calendar comparisons, those economic challenges are likely to weigh more on new development and deals. U.S. RevPAR grew 16.7 percent when comparing Q1 2023 to Q1 2022. That growth was driven primarily by ADR, which was up 10.2 percent year over year. Industry executives also displayed plenty of confidence during recent earnings calls with optimistic expectations for the remainder of the year.

With the pandemic impact faded from the calendar, however, growth levels were down substantially from prior-year increases of +38.3 percent (ADR) and +68.5 percent (RevPAR). That slowing is an indicator of what’s to come with STR and Tourism Economics projecting a single-digit RevPAR increase for this year. As a result, we can expect to see further slowing in an already-sluggish development and transactions setting.

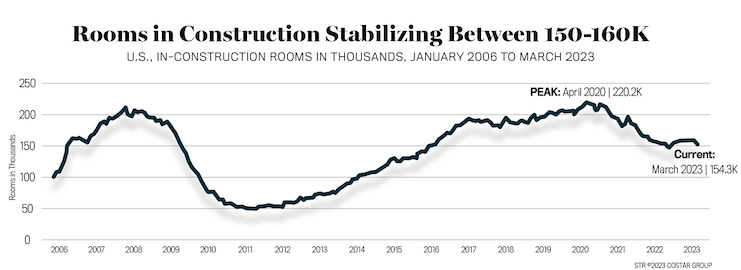

The number of rooms in construction showed little movement in the first quarter of 2023 with just over 150,000 rooms in that final phase of the pipeline. That total is likely to decelerate as financing continues to tighten. While projects that have already broken ground are expected to be completed, we would expect a sharp increase in the number of rooms sitting within the final planning stage should lending standards tighten further. That would lead to a deceleration in the number of hotel rooms under construction. The benefit should that happen is hoteliers gaining more breathing room with their existing supply, as less competition is hitting the marketplace.

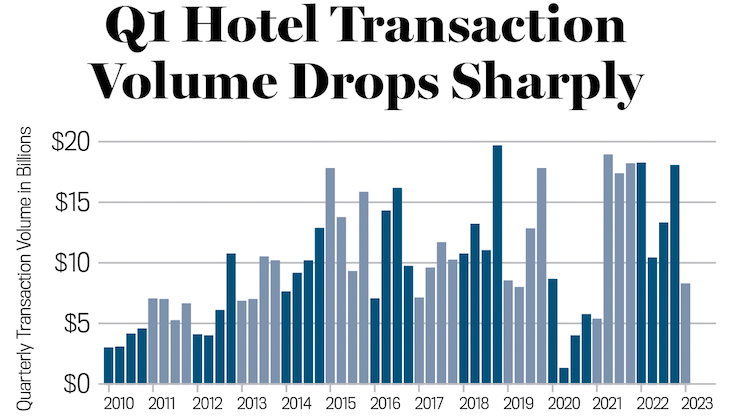

Transaction volume showed a sharp decline for the first quarter of 2023. The metric sat at $7 billion after coming in at more than $15 billion during the fourth quarter of 2022. Slowing in lending could lead to more uncertainty for hotel owners and perhaps more distressed sales later in the year. While massive year-over-year growth is behind the industry at this point, remember there is a reason that executives are so confident. The U.S. hotel industry is resilient, and any growth on top of the strong pent-up travel periods of the last two years is remarkable—especially considering economic woes.