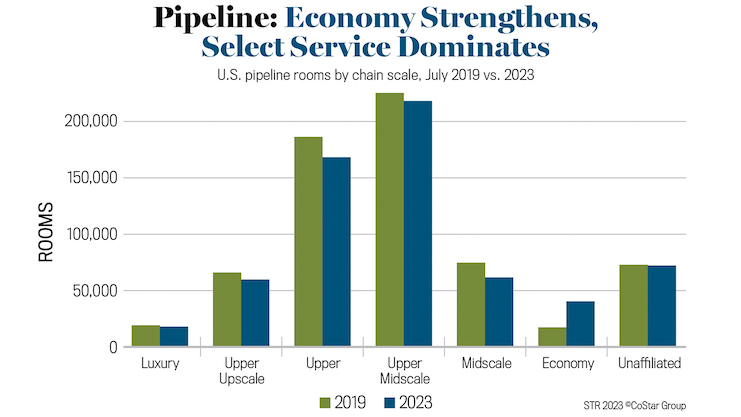

While the pandemic and more recent macroeconomic conditions have slowed U.S. construction activity, the overall hotel pipeline in 2023 isn’t that far off from 2019. Today there are 633,000 rooms in that pipeline compared to 656,000 in 2019. The difference, of course, is far fewer rooms under construction today, which is not surprising given the previously mentioned factors. What balances out the overall comparison, however, is far more projects in planning than in 2019.

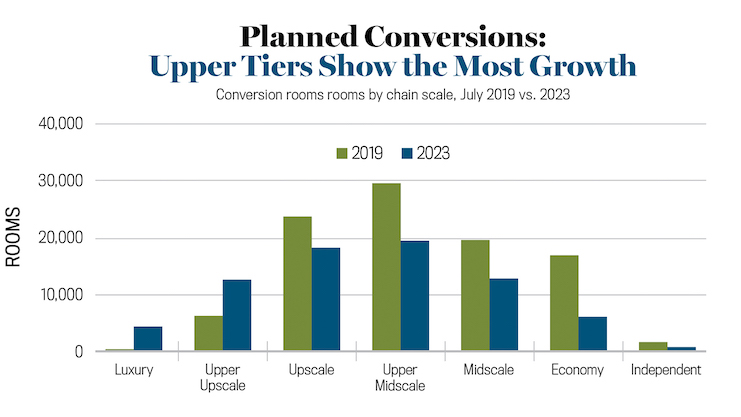

More aligned with the slowdown in construction, planned conversions have slowed in comparison with 2019. In that final year before the pandemic, more than 98,000 rooms were being converted to a different brand. In 2023, approximately 74,000 rooms are planned to be converted. In both years, most brand conversions involved a move from one chain scale to another (78 percent), while a minority changed brands within the same chain scale (22 percent).

To understand the future of overall lodging development, it is useful to analyze how pipeline development vs. planned conversions impacts the chain scale mix.

The current mix of brands demonstrates the continued strength of the upscale and upper midscale segments, which represent more than 60 percent of all rooms in development today—just like in 2019. There has been a slowdown in development across all chain scales except for economy, which shows almost twice as many rooms in the pipeline now than in 2019. This rate of economy development should be tempered with the fact economy chains experienced a 7 percent drop in room supply from 2019 to 2023.

Looking at planned conversions yields a different story. The same two chain scale segments dominating the pipeline—upscale and upper midscale—show fewer planned conversions, and the same is true for midscale and economy. For luxury and upper upscale chain scales, planned conversions have increased, which presents a different story than the overall pipeline. It should be noted that the number of rooms marked for conversion is considerably less than the number of new development rooms. There are almost nine times more rooms in the pipeline than rooms planned for conversion—633,000 rooms in the pipeline compared to 74,000 rooms in conversion.

While the charts (right and facing page) reveal increases across all chain scales in both pipeline growth and planned conversions, the tale of two development approaches is revealed when examining the change over time. In comparison to our benchmark year of 2019, there is greater appetite for new development in the economy chain scale with net room growth in new supply increasing at more than twice the level of declines in planned conversions. And on the other side, there is net greater interest in conversions in the luxury and upper upscale chain scales compared to pipeline development, although the comparison is more muted than the economy comparison.

Further analysis of the timing of conversions and new development—as well as understanding the brand makeup of both given the proliferation of new brands recently announced by almost all the major hotel companies—are important as the industry marches into the new normal.