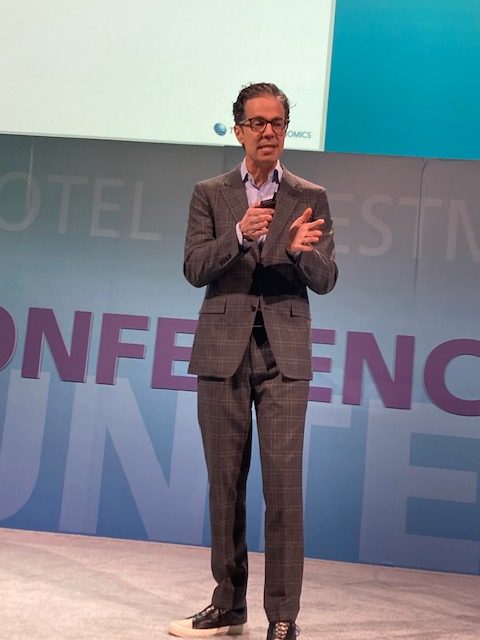

While acknowledging a “mild recession” is likely in ’23, economist Adam Sacks nonetheless delivered generally positive news for hospitality during the keynote session at the Hunter Hotel Investment Conference vowing “we can get back to normal” in terms of room demand.

Sacks—who is president of Tourism Economics—answered the question posed in the title of the session, “Can the Travel Industry Defy Economic Gravity?” with a resounding “yes.” He cited four primary reasons for his contention in the form of pent-up travel demand, the new hybrid work environment, and the return of both business travel and international visitors.

Sacks conceded the GDP (gross domestic product) is expected to contract in the third and fourth quarters of this year roughly a percentage point while noting the U.S. is “entering a period of economic weakness.” However, he said GDP for 2023 is still expected to experience overall growth as he downplayed the impact of any downturn.

“It’s very different from past recessions. This will stand out as one of more mild ones, close to what we saw in 1991,” he said.

Sacks further commented, “It’s not that crazy of an idea that even though the economy may go into reverse for the latter part of this year that room demand, relative to 2019, continues to eke out gains, small as they may be. It will continue to grow and that growth will accelerate into 2024,” he said.

Specifically as it relates to pent-up demand, Sacks referenced a recent Expedia survey which indicated that consumers have prioritized travel, particularly in the wake of the pandemic.

“Maybe it’s still the effect of COVID, maybe it’s people realizing there’s more valuable things to do with their lives. Expedia’s data is bearing out momentum and continued heightened interest in travel. What’s interesting is if you look at how consumers are spending their money,” he said, adding that retail sales results have declined dramatically.

Sacks also highlighted the importance of the remote work trend citing a recent Travel Sentiment Study that revealed that some 34 percent of people plan to travel as they work remotely.

“I want to add to this argument this idea of the effect of remote and hybrid work. This is not traveling for work, this is traveling while working,” he said.

Meanwhile, the return of business travel can go a long way in helping move things forward.

A recent JD Power Airport survey revealed that in the fourth quarter of 2022 business travelers expected to travel at 101% of 2019 levels over the coming six months.

“That’s a pretty big jump from 95% in the third quarter, especially for conferences and trade shows and for customer stakeholder meetings. We’re not quite there but recovering on internal meetings. So you see this momentum that is still behind us in terms of the rebuilding of business travel,” he noted.

Finally, Sacks noted international travel could provide a significant boost to room demand as well.

“We expect international markets to continue to rebuild. The economic tide we do expect to go out in the second half of this year, but the tide of international inbound travel will be the prevailing tide as we move through ’23 and even into ’24,” he commented.

Furthermore, Sacks also referenced the continued building of occupancy in the higher end of the market, namely the luxury, upper-upscale and upscale segments, adding that the “greatest weakness” has been in the economy sector of late.

Sacks concluded by reinforcing his positive message despite the economic challenges.

“Things are going to get back to normal and room demand is going to find its rightful place relative to the size of the economy,” he predicted.