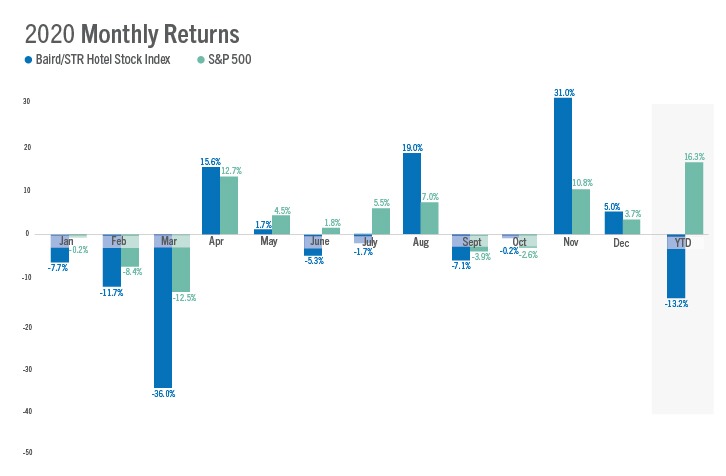

HENDERSONVILLE, Tennessee, and MILWAUKEE — The Baird/STR Hotel Stock Index was up 5 percent in December to a level of 4,574. For 2020 as a whole, the stock index fell 13.2 percent.

“Hotel stocks continued their rebound in December as the positive vaccine and reopening sentiment remained front and center for investors,” said Michael Bellisario, senior hotel research analyst and director at Baird. “Despite the significant pandemic-related impact to hotel demand that occurred in 2020, hotel stocks performed relatively better than they did in 2011, 2015, and 2018, which demonstrates how forward-looking the stock market is today.”

“Despite a travel boost into the New Year’s holiday, December was the second consecutive month with worsened hotel occupancy,” said Amanda Hite, STR president. “With COVID cases soaring and economic limitations continuing, we are forecasting a slow start to the year. Mathematically speaking, 2021 will be the single best year on record with regards to RevPAR growth, but that is cold comfort for the myriad of hotels currently in limbo. Industry stakeholders continue to hope for a swift vaccine rollout to the traveling public to finally put 2020 behind us.”

In December, the Baird/STR Hotel Stock Index outperformed both the S&P 500 (up 3.7 percent) and the MSCI US REIT Index (up 2.7 percent).

The Hotel Brand sub-index jumped 5.2 percent from November to 7,967, while the Hotel REIT sub-index increased 4.4 percent to 1,115.