Effectively managing and marketing hotel properties sometimes requires an outside perspective. This is why owners will frequently pay third parties fees and commissions for a variety of services, including operating and marketing the hotel, facilitating guestroom rentals, and processing credit card payments, among others.

Given the current operating environment, U.S. hotel owners have shifted their focus from revenues to expenses. In 2018, the hotels that participated in CBRE’s annual Trends in the Hotel Industry survey spent 13.2 percent of their total operating revenue on credit card commissions, franchise fees, travel agent commissions, and management fees. For reference purposes, total labor costs for the sample equaled 30.7 percent of total operating revenue.

Most fee and commission payments are a function of a percent of a corresponding revenue. Therefore, it is of great concern to hoteliers that since 2010, most fees and commissions have risen at a compound annual rate greater than their corresponding revenue. With these costs growing faster than revenue, hotel profit margins are negatively impacted.

In 2018, hotels spent 13.2 percent of their total operating revenue on credit card commissions, franchise fees, travel agent commissions, and management fees.

To examine how changes in third-party fees and commissions have impacted hotel profitability, CBRE has analyzed the annual changes in travel agent commissions, credit commissions, franchise fees, and management fees. For each category we examined a dedicated sample of properties that paid that fee in each of the past five or eight years.

Travel Agent Commissions

Hoteliers pay commissions to intermediary agencies that facilitate booking guestrooms. This includes rooms rented by both transient and group travelers. The agency typically charges commissions as a percentage of rooms revenue.

Commensurate with the adoption of the 11th edition of the Uniform System of Accounts for the Lodging Industry, CBRE began to track travel agent commissions in 2015. From 2015 through 2018, travel agent commissions for the properties in the Trends sample increased at a compound annual growth rate (CAGR) of 3.9 percent. Concurrently, rooms revenue for the sample grew at a CAGR of 1.7 percent.

Feedback from CBRE clients and data partners indicate that commission rates have increased somewhat, and intermediaries are increasingly becoming involved in certain demand types and distribution channels that have historically been booked directly by the hotel (for example, groups). It is important to note that travel agent commissions are just one component of the total revenue acquisition costs that are now being tracked and benchmarked to measure the profitability of different distribution channels.

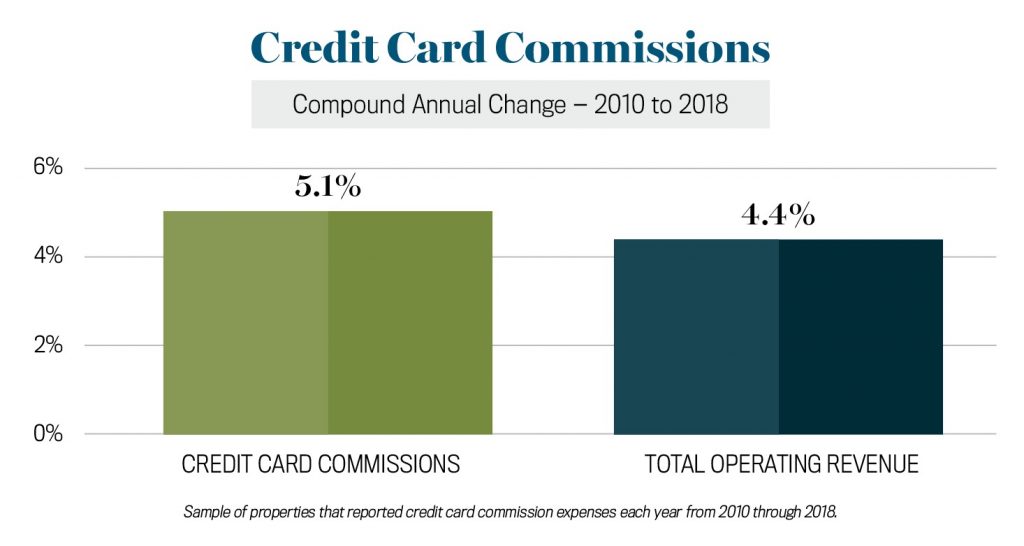

Credit Card Commissions

Commissions are one of several fees hoteliers pay to banks and processing firms to handle guest settlements made by credit cards. Since all services within a hotel can be paid for using a credit card, these commissions are typically analyzed as a percent of total operating revenue.

From 2010 through 2018, credit card commissions for the properties in the Trends sample increased at a compound annual growth rate (CAGR) of 5.1 percent. This is greater than the 4.4 percent CAGR in total operating revenue during the same period. Rising credit card discount rates, plus the increased use of credit cards to pay for group-related revenues, are cited as primary reasons for the rise in this expense. Hotel owners and operators can take solace knowing the increased use of credit cards usually reduces the amount of bad debts.

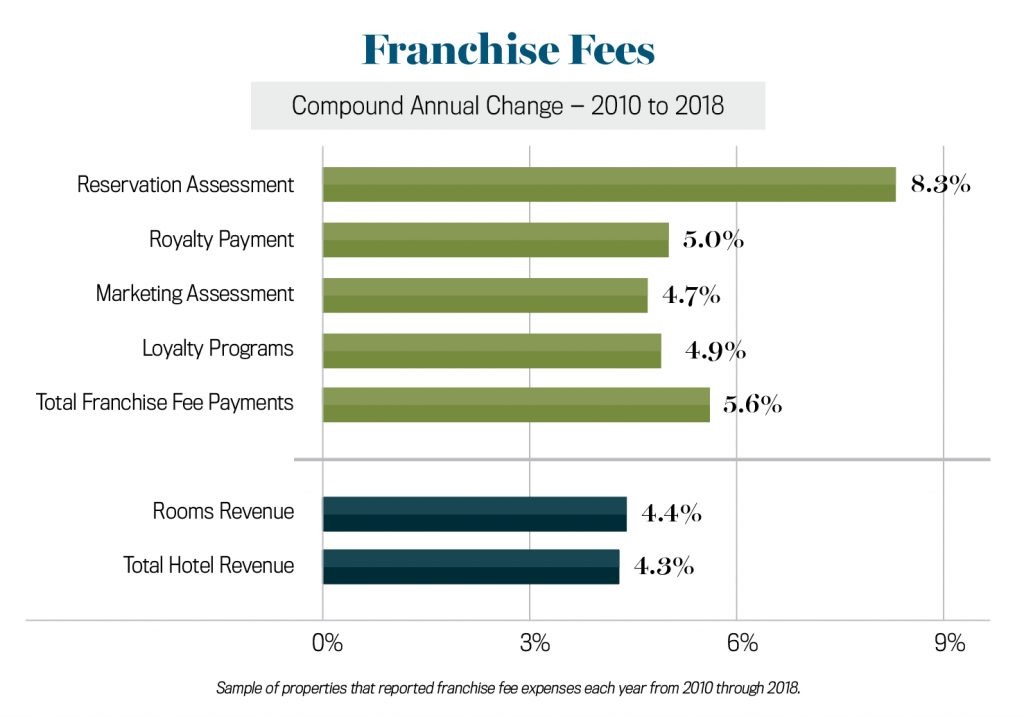

Franchise and Management Fees

CBRE tracks four fees typically charged by franchise companies: reservations assessment; royalty pay; marketing assessment; and loyalty program fees. Most franchise fees are assessed to a hotel based on a percent of rooms revenue. In 2018, the combined expense for the four franchise-related expense categories analyzed equaled 7.9 percent of rooms revenue at the Trends properties that reported paying franchise fees. From 2010 through 2018, those properties reporting a franchise fee payment for each of the eight years saw their combined franchise fees increase at a CAGR of 5.6 percent. Rooms revenue for the sample properties grew at a CAGR of 4.4 percent. Each of the four individual franchise fee components grew more than the rooms revenue CAGR of 4.4 percent. The reservation assessment increased the most (8.3 percent), while the marketing assessment grew the least, at 4.7 percent.

Owners without the requisite expertise frequently hire a specialized management company to operate a hotel on a day-to-day basis. The management companies are compensated with management fees. Management fees consist of two main components: a base fee predicated on total operating revenue and an incentive fee earned when the hotel achieves an agreed-upon level of profit.

From 2010 through 2018, total management fees for the properties in the Trends sample increased at a CAGR of 6.7 percent. Concurrently, total operating revenue for the sample grew at a CAGR of 4.3 percent.

Within management fees, the incentive fee has been the primary growth driver since 2010. During the eight-year period, base management fees increased by a CAGR of 5.4 percent, while the incentive fees have grown by a CAGR of 15.6 percent. This is consistent with the strong 7.1 percent CAGR in earnings before interest, taxes, depreciation, and amortization. Hotel owners welcome a rise in incentive fee greater than revenue growth. This typically means the operator is achieving (or exceeding) the agreed-upon profit targets.

Value and Transparency

With fee and commission growth exceeding the increases in the revenues they are respectively based on, owners are beginning to question the value the brands, management companies, and intermediaries they contract with provide. Owners require additional data to properly analyze the value proposition of each service. This has resulted in requests for greater transparency in the fees charged by service providers.

This article originally appeared in the March 2020 issue of LODGING.