Although we are well into the new year, the global hotel industry is still facing many of the same struggles from years past, including staffing shortages. Those shortages are pushing hotels to increase pay and benefits to compete for available labor.

When looking at the United States, average hourly earnings for employees in the leisure and hospitality sector are the highest they have ever been—averaging $23.37 in 2023 and hitting $23.86 in January 2024, according to data from the Bureau of Labor Statistics. In 2023, total labor expenses hit a whopping $56.7 billion in the United States, up 14.2 percent from the previous year.

Tracking profitability data since 1990, STR shows labor costs at an annual growth rate of 2.1 percent. Averages have increased by double digits over the last three decades, and that pattern is likely to continue through the 2020s. Labor costs on a per-available-room basis (LPAR) peaked in 2023 at $72 and reflect the increased pay the industry has had to dish out to try to mitigate staffing shortages.

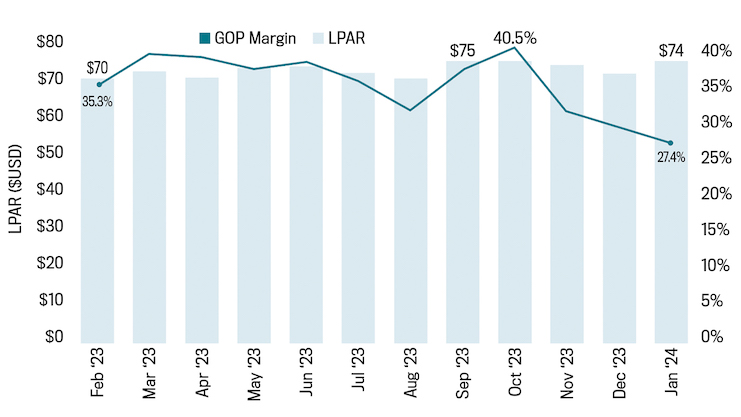

Increased operational expenses, particularly labor, have been pinching GOP margins more and more. Labor costs account for over half of the total operational expenses (56 percent as of January 2024), which is why they weigh so heavily on profits. GOP margins have averaged 30.4 percent over the last four years, lower in comparison to previous decades: 1990s (41.8 percent), 2000s (35.3 percent), and 2010s (35.5 percent).

Narrowing in on the U.S. labor trends of the last 12 months, LPAR has averaged $72, while GOP margins have averaged 35.4 percent. The monthly average growth rate (MAGR) for LPAR is 0.6 percent, which doesn’t seem like much, but that is 0.7 percentage points higher than the same period in 2019.

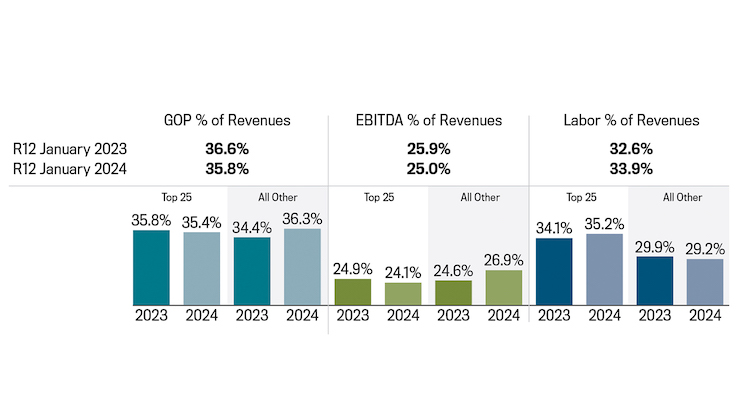

The impact of labor costs is even more profound for the Top 25 Markets, with LPAR at $83 over the last 12 months (+13 percent YoY) vs. only $56 for all other markets. Despite the LPAR increase, GOP margins were up 1.8 percentage points because of strong growth (10 percent) in total revenue per available room growth (TRevPAR).

While all major markets have realized growth in LPAR, those that have posted the largest LPAR increases (averaging 19.2 percent) are Nashville, Seattle, Washington, D.C., St. Louis, and Houston.

While one may think the markets with the highest LPAR percent change have the lowest levels of gross operating profit per available room (GOPPAR), it’s actually the markets that have been unable to make gains in total revenue per available room (TRevPAR). Miami,

New Orleans, San Diego, Anaheim, San Francisco, and Los Angeles realized LPAR growth between 7.7 percent and 14.7 percent, which is considered moderate to low. Growth in that metric, coupled with a TRevPAR percentage change of –1 percent to +5 percent, led to flat or negative GOPPAR changes across the aforementioned markets. Although labor is growing across all top markets, it’s those markets that are unable to drive any real growth in total revenues that are realizing a greater impact on the bottom line.

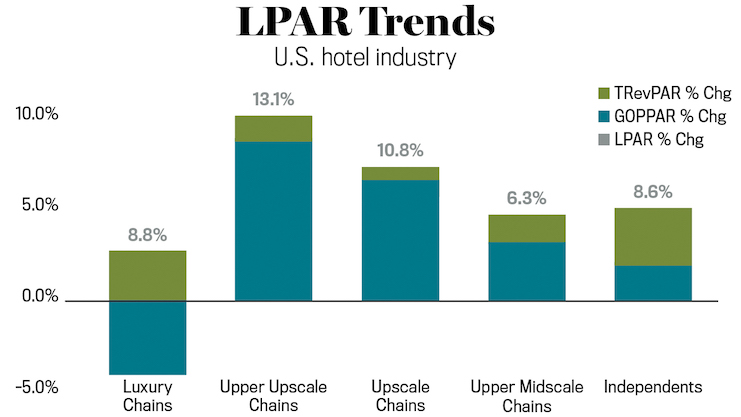

When looking at service types, full-service hotels are realizing a much larger increase in LPAR versus limited service, +12.2 percent vs. +6.9 percent, respectively. However, both service types are realizing strong growth in TRevPAR: full service at +4.8 percent and limited service at +5.1 percent, which has allowed for improvements in GOPPAR. Upper upscale and upscale chains continue to realize enough TRevPAR growth to combat the rise in LPAR, which has allowed for profit growth. The growth in KPIs for these chain scales points to continued recovery of groups. The only chain scale experiencing profit declines is luxury, where a 2.7 percent TRevPAR increase was not nearly enough to fight off the 8.8 percent growth in LPAR.

As hoteliers navigate the ever-rising growth in labor costs, it becomes increasingly evident that sustaining profitability hinges on both controlling the growth through new creative operational adjustments and technology (e.g., flexible schedules, less room

cleaning, F&B robots) and growing top-line revenues.