Per the Uniform System of Accounts for the Lodging Industry (USALI), the income received from transient and group guests who fail to occupy a room or cancel a reservation in the prescribed timeframe, and for which payment was guaranteed on an individual basis, is recorded as “No Show Revenue” in the Rooms Department. The fees a hotel receives from the cancellation of group meetings are typically presented as a separate line item in miscellaneous income.

CBRE Hotels Americas Research captures attrition and cancellation fee data when conducting our annual Trends in the Hotel Industry survey. The USALI defines cancellation fees as “income received from transient guests and groups that cancel their reservations for guestrooms, food and beverage, and other services after a contracted or cutoff date.” Attrition fees are defined as “income received from groups that do not fulfill their guaranteed number of reservations for guestrooms, food and beverage, and other services.”

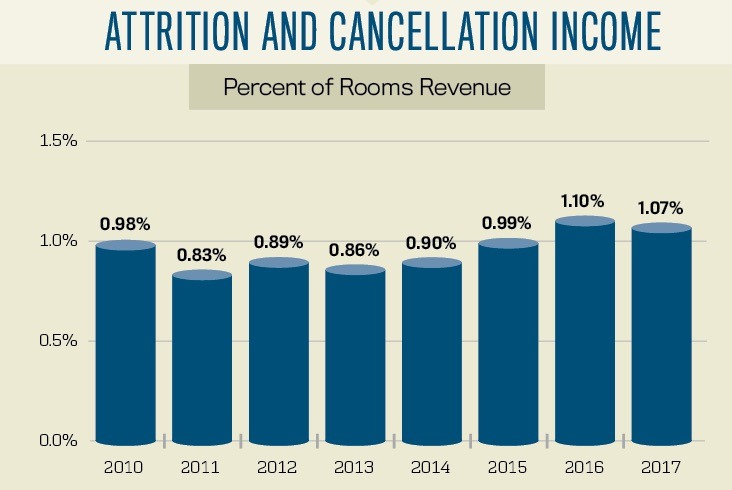

Based on a sample of 308 U.S. hotels that reported attrition and cancellation fees each year from 2010 through 2017, we are able to analyze trends in this source of income as the industry recovered from the Great Recession in 2009 and 2010.

Changes in Fee Income

When observing annual changes in attrition and cancellation fee income from 2010 through 2017, we see variances that can be explained by the overall health of the U.S. lodging industry, as well as the group-demand segment.

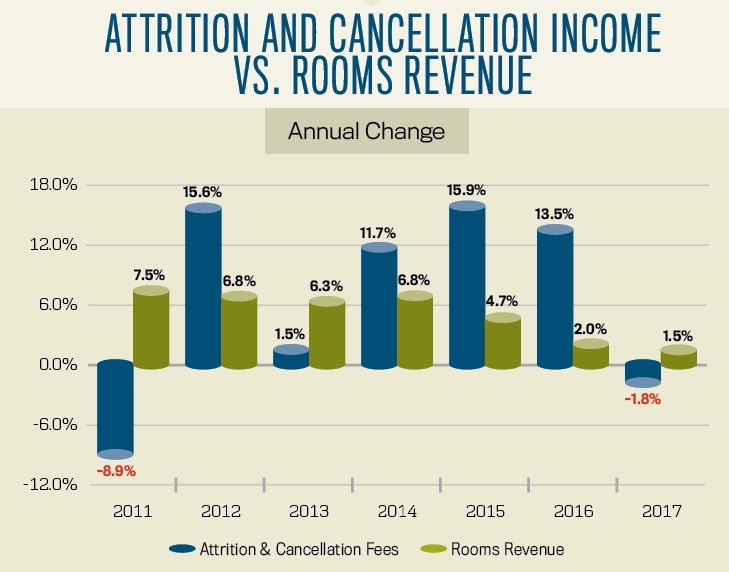

The Great Recession had an extremely negative impact on group demand. Cost controls, combined with the stigma of the “AIG Effect,” caused businesses and associations to cancel their meetings. In 2009 and 2010, attrition and cancellation fees became a significant source of revenue. Therefore, it is not surprising that in 2011, attrition and cancellation fee income declined by 8.9 percent from that in 2010. This occurred while rooms revenue increased by 7.5 percent.

Attrition and cancellation fee revenue increased at an average annual rate of 11.6 percent from 2012 to 2016.

Rooms revenue continued to grow at a steady pace from 2012 through 2016. According to STR, accommodated group room nights in the U.S. returned to pre-recession levels in 2014. With the return of group demand and high occupancy levels, hotel sales managers felt more empowered, and became more aggressive in the inclusion and enforcement of attrition and cancellation policies. Attrition and cancellation fee revenue increased at an average annual rate of 11.6 percent during this five-year period.

In 2017, as rooms revenue growth decelerated to 1.5 percent, attrition and cancellation fee revenue declined by 1.8 percent. Based on conversations with clients and industry professionals, uncertainty has influenced meeting planners and shortened the lead time for booking events. Businesses and associations are now investing in meetings that are absolutely necessary, thus providing a greater assurance that the event will take place.

Contribution to Revenues and Profits

Despite the previously mentioned changes in attrition and cancellation fee income, this revenue source has remained steady as a percentage of total operating revenue. In 2010, attrition and cancellation fee income equaled 1 percent of total operating revenue. This metric declined to 0.8 percent in 2011, but rose to 1.1 percent of total operating revenue in 2016 and 2017.

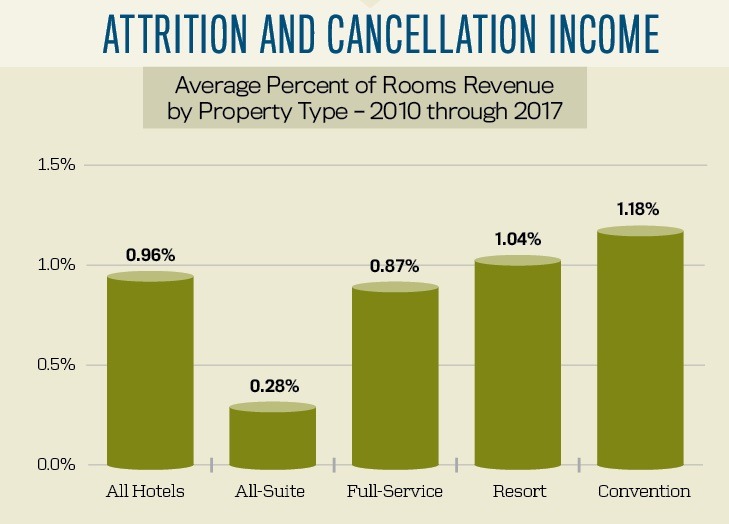

By property type, attrition and cancellation fees have been most significant as a source of revenue at convention hotels.

By property type, attrition and cancellation fees have been most significant as a source of revenue at convention hotels. From 2010 through 2017, this source of income averaged 1.2 percent of Total Operating Revenue at convention hotels, followed by 1 percent at resort hotels. This makes sense, given the group orientation of these two property types. Attrition and cancellation fees are less significant as a source of revenue at full-service (0.9 percent) and all-suite (0.3 percent) properties.

While attrition and cancellation fee income has been a minor source of revenue for hotels, it can have an impact on profitability. Since a minimal amount of variable expense is incurred to earn attrition and cancellation fee revenue, it can be assumed that most of the penalty payments received by hotels drop right to the bottom line. Accordingly, it is proper to analyze this source of revenue as a percent of Gross Operating Profit (GOP).

As a percentage of GOP, attrition and cancellation fees averaged 1.7 percent from 2010 through 2017. This ratio ranged from a low of 1.6 percent in 2013 to a high of 1.9 percent in 2010. Convention hotels have benefited the most among property types from attrition and cancellation fees, with an average GOP ratio of 2.1 percent.

Adjusting

The consistent ratio of attrition and cancellation fees to rooms revenue shows how hotels and sales managers adjust to changing market environments. When the economy is strong and businesses and associations book more meetings, it increases the potential to collect more attrition and cancellation fee revenue and empowers sales professionals to enact stricter cancellation attrition clauses in their contracts. Conversely, when the economy is soft and fewer meetings are held, attrition and cancellation fee revenue can either rise because of more cancellations or decline as sales managers offer leniency to meeting planners to maintain a long-term relationship.