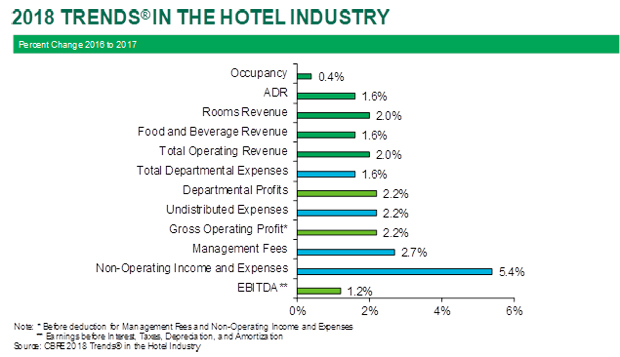

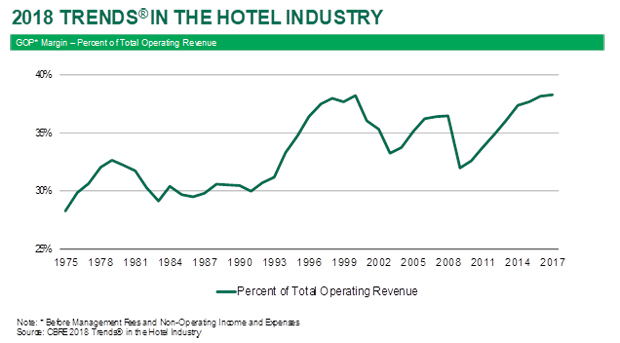

Atlanta–U.S. hoteliers enjoyed an eighth consecutive year of increasing profits in 2017 despite another slowdown in the rate of revenue growth. According to the recently released 2018 edition of Trends in the Hotel Industry by CBRE Hotels’ Americas Research, total operating revenue increased by 2 percent in 2017 for the average hotel in its survey sample. By limiting the growth in operating expenses to 1.9 percent, the managers surveyed saw a 2.2 percent increase in gross operating profits (GOP) for the year. By matching the 2 percent gain in revenue with a 1.9 percent rise in expenses, the GOP margin for those surveyed increased to 38.3 percent in 2017. This is the highest profit margin recorded by CBRE since 1960 and an indication of the efficiency and productivity of U.S. hotels.

“It is becoming increasingly difficult for U.S. hotels to achieve both revenue and profit gains. Within the 2018 Trends sample, only 59.1 percent of the properties enjoyed an increase in total operating revenue in 2017, while just 52.3 percent attained growth in profits. These are the lowest levels observed since the depths of the recession in 2009,” Mark Woodworth, senior managing director of CBRE Hotels’ Americas Research, says. “Increasing competition from new supply, muted growth in average daily rates (ADR), and upward pressure on labor costs make the current operating environment one of the most challenging our firm has seen since we started tracking industry performance in the 1930s.”

CBRE’s annual report surveyed thousands of hotels across the nation. The 2017 operating data collected for the 2018 survey was compiled in accordance with the 11th edition of the Uniform System of Accounts for the Lodging Industry.

Labor Costs

The tight labor market has put upward pressure on industry wage rates. Per the Bureau of Labor Statistics, the average hourly compensation rate for hospitality employees rose 3.8 percent in 2017. For the hotels that CBRE surveyed, total labor costs (i.e., salaries, wages, and benefits) increased by 1.8 percent. This implies a reduction in the number of hours worked, according to CBRE.

Jack Corgel, professor of real estate at the Cornell University School of Hotel Administration and senior advisor to CBRE Hotels’ Americas Research, notes, “In addition to controlling the schedule, hotel managers gained greater productivity from their staff. With fewer hours, the employees at these same hotels serviced 0.4 percent more occupied rooms, as well as greater volumes of food and beverage revenue.”

“We continue to be impressed by the way U.S. hoteliers are dealing with labor costs, the largest expense for hotels,” Corgel continues. “It is a very tight labor market, especially in the leisure and hospitality industry. According to the Bureau of Labor Statistics (BLS), the current level of open jobs in the sector equates to 5.3 percent of the total personnel currently employed. This is the highest level since 2000 and indicative of the difficulty hospitality managers are having finding qualified employees.”

Overhead Concerns

While hoteliers continue to control labor costs, CBRE observed an increase in non-labor related expenses in 2017. During the year, labor costs increased by 1.8 percent and all other costs rose by 2 percent, with the greatest increases in undistributed departments where, in aggregate, expenses grew by 2.2 percent. Compared to the operated departments, undistributed costs are relatively fixed in nature and therefore less controllable by management.

“The most obvious cost increase in 2017 was utilities which grew by 1.4 percent. The 1.4 percent growth rate is not that alarming, but this is the first time since 2013 U.S. hoteliers have not benefited from a decline in utility costs,” Woodworth observes.

There were some non-labor related costs that rose more than revenue in 2017. These include technology-related expenditures, franchise fees, credit card commissions, and the cost of complimentary food, beverage, and services. Below GOP, management fees and property taxes also increased at a greater pace than the 2 percent growth in revenues.

“Property owners did find some solace in the 4.2 percent insurance costs decline in 2017. However, given the number of natural disasters that occurred during the year and the sluggish start to the stock market in 2018, we may see a boost in premiums this year,” Corgel says.

Can Profits Continue To Grow?

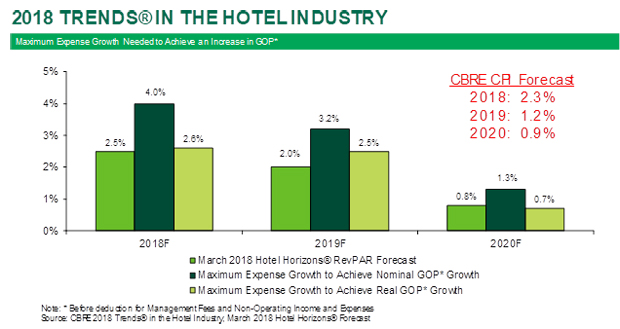

According to the March 2018 edition of CBRE’s Hotel Horizons forecast report, annual RevPAR gains for U.S. hotels are projected to range from 0.8 percent to 2.5 percent from 2018 through 2020. Given this rate of revenue expansion, can hotels continue to achieve profit growth? For hotels to achieve profit growth that keeps pace with inflation, expense growth must be limited to 2.6 percent or less over the next few years. Keeping in mind that the annual average expense growth rate since 1960 is 4 percent, this will be an enormous challenge.

“We are in a very interesting period for hotel owners. On the one hand, lodging revenues seem comparatively durable, and hotels are achieving record level profit margins. On the other hand, a profit growth slowdown amplifies the looming reality that renovation requirements and other capital-intensive needs become more apparent as the current up-cycle persists,” Woodworth concludes.