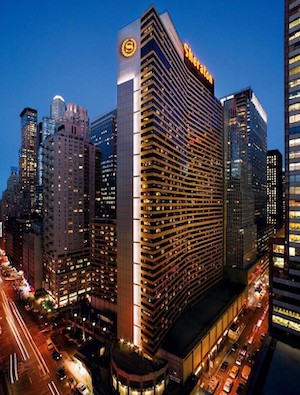

NEW YORK—MCR Hotels, Island Capital Group, and JLL’s Hotels & Hospitality Group announced that MCR and Island have closed on a $260 million refinancing of the 1,780-key Sheraton New York Times Square.

The four-year, floating-rate loan retires $250 million in outstanding seller financing that was sourced when MCR Hotels and Island Capital acquired the hotel in April 2022. The new financing was provided by funds managed by affiliates of Fortress Investment Group LLC.

Andrew Farkas, managing member, chairman, and CEO of Island, said, “Successfully refinancing the Sheraton New York Times Square’s loan is a key component of our strategy to help the hotel capture additional market share and ensure it remains a premier destination on a long-term path for continued success. We greatly appreciate both MCR’s and JLL’s support and partnership.”

“We are pleased to complete the refinancing of the Sheraton New York Times Square,” said Tyler Morse, chairman and CEO of MCR. “The hotel’s performance has rebounded since we acquired the hotel, which we believe is a testament to the strength of New York City’s lodging market. We are looking forward to working with Island and Fortress over the next several years to reinforce the Sheraton’s position as one of Manhattan’s leading hotels.”

The Sheraton New York Times Square is located in Midtown Manhattan at the northern end of the prime Times Square retail corridor. The hotel is close to NYC tourist attractions including Radio City Music Hall, The Museum of Modern Art, Central Park, Rockefeller Center, and more.

The 50-story hotel is one of New York City’s largest by key count and one of the event venues in the city. The hotel has 61,800 square feet of meeting space across several floors, and it is one of a few hotels that can accommodate large groups, with a 23,000-square-foot ballroom. The hotel’s amenities include on-site food and beverage options, including Hudson Market, Starbucks Café, and the Library Bar, a fitness center, a business center that complements meeting venues, on-site parking, and a collection of ground floor retailers.

Kevin Davis, Americas CEO of JLL’s Hotels and Hospitality group, said, “We are in the midst of a strong recovery across all segments of New York City’s hotel market. This refinancing is indicative of improved debt capital markets sentiment in New York, which we expect will persist as the hotel market continues to benefit from the recovery of group, business transient, and foreign travel demand.”

The JLL team was led by Davis, Managing Director Mark Fisher, and Analyst Russell Freed. Fried Frank served as legal advisor to MCR and Island.