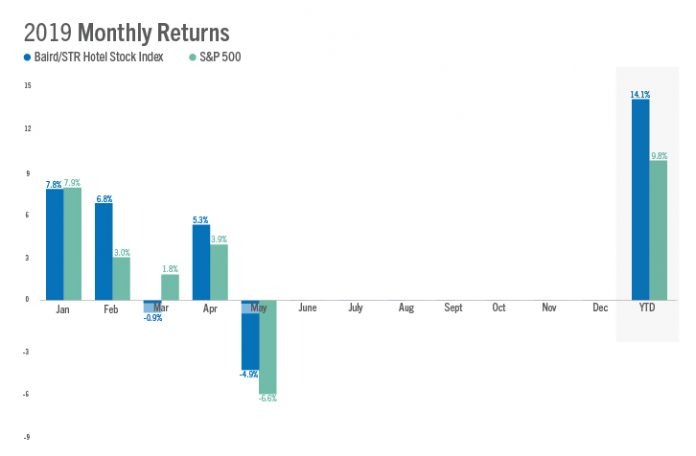

HENDERSONVILLE, Tennessee, and MILWAUKEE—The Baird/STR Hotel Stock Index dropped 4.9 percent in May to 4,645. Year-to-date through the first five months of 2019, the index was up 14.1 percent.

“Hotel stocks fell in May and tracked the pullback that occurred in the broader stock market during the month,” said Michael Bellisario, senior hotel research analyst and VP at Baird. “With volatility increasing and interest rates falling due to heightened concerns surrounding tariffs and slower macroeconomic growth, hotel stocks expectedly declined. While the Hotel Brand Sub-Index modestly outperformed the broader stock market, the Hotel REIT Sub-Index materially underperformed its real estate benchmark as investors became more defensively positioned.”

“We had been seeing positive investor sentiment despite lackluster industry performance, so it is not surprising to see this negative shift,” said Amanda Hite, STR’s president and CEO. “We downgraded our forecast released last week at the NYU Conference, but we continue to project growth even if it is coming in at a below-average rate. We’re aligned with industry stakeholders with concern over trade wars, labor costs, and inbound tourism, but indicators remain in place for positive performance moving forward, especially during the busy summer months.”

May performance of the Baird/STR Hotel Stock Index was better than the S&P 500 (-6.6 percent) but fell below the MSCI US REIT Index (flat).

The Hotel Brand sub-index decreased 4.1 percent from April to 7,216 while the Hotel REIT sub-index declined 6.7 percent to 1,506.