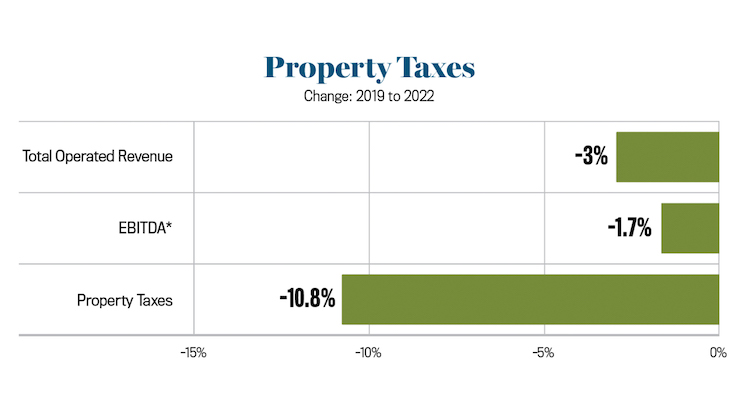

Based on a sample of more than 3,000 hotels from CBRE’s Trends in the Hotel Industry database, U.S. hotel property tax expenditures averaged $2,626 per available room (PAR) in 2022. This is 10.8 percent less than the $2,943 PAR recorded in 2019, before the COVID-19 pandemic. Concurrently, the earnings before interest, taxes, depreciation, and amortization (EBITDA) for these same properties fell by 1.7 percent.

From 2019 to 2022, the combination of EBITDA decreases and cap-rate increases put downward pressure on values. A 100 bp increase in cap rates, coupled with the 1.7 percent decrease in EBITDA, correlates to a 12.6 percent loss in value. Therefore, it appears that property tax decreases did not keep up with the sharp drop in property values.

In general, this is not good news for the owners of U.S. hotels. However, a deeper analysis of the data reveals that the ability of hotel owners to control their property taxes varies by location across the country. Since property taxes are levied at the local level, each municipality has different tax rates, assessment policies, and tax calendars. Furthermore, taxing agencies have shown different levels of leniency during the past three years as hotels have recovered from the severe declines experienced in 2020.

To assess recent trends in U.S. hotel property taxes, we analyzed the performance of 3,255 hotels that reported property tax payments each year from 2019 through 2022 for our annual Trends survey. In 2022, these properties averaged 200 rooms in size, with an occupancy of 66.9 percent and an average daily rate of $196.27. Excluded from this analysis were any hotels that did not pay property taxes in any of the four years, and hotels that may have received a property tax rebate resulting in a net negative property tax obligation for a year.

Property Tax Relief Lagged

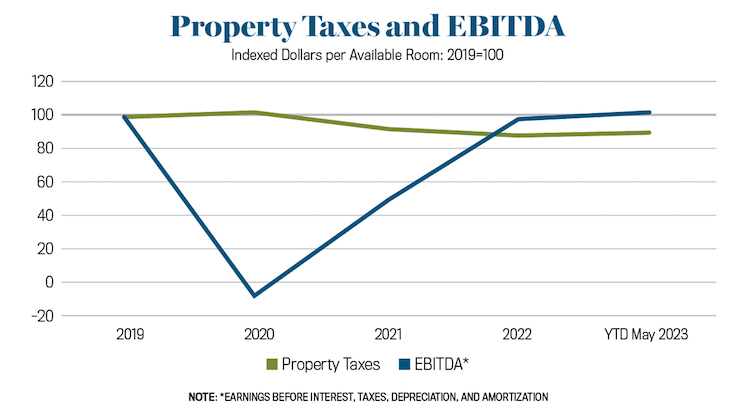

In 2020, the hotels in the study sample suffered a 62.8 percent decline in total operating revenue, which resulted in an EBITDA decline of 107.3 percent. An EBITDA decline of more than 100 percent implies that the owners of these hotels suffered a true loss for the year and had to pay their operating and ownership expenses “out of pocket.” In the same period in 2020, property taxes grew by 2 percent despite the severe loss in top-line revenue. This disparity in the direction of profits, values, and property taxes occurred because many municipalities generally tax in arrears, meaning that they base their tax assessments on the previous year’s performance. Still, others work off of multiyear cycles, so unless the assessed values were appealed mid-cycle, their respective assessments may have still been working off of a prior year peak or near-peak performance.

Fortunately for hoteliers, we observed a decline in property tax payments in both 2021 and 2022. This occurred even though EBITDA rebounded significantly in both years. We believe this favorable difference is the result of the previously mentioned valuation in arrears or is a product of successful property tax appeals and/or forbearance exercised by taxing authorities. We note that many states or municipalities actively looked to assist hotel owners by temporarily rolling back either assessments or taxes. These forbearances have all but burned off in 2023, and we are seeing sharp increases in assessed values across the country.

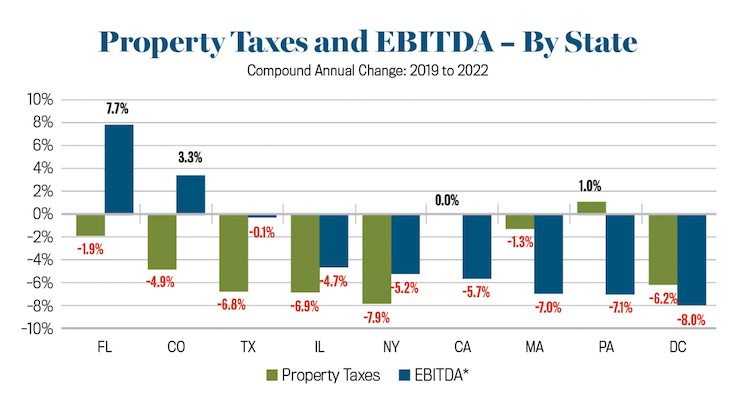

Differences by State

We have analyzed historical hotel property tax trends by state from 2019 through 2022, as tax policies vary from state to state or even county by county. We found an inverse relationship between changes in EBITDA and changes in taxes. In general, hotels located in states that have enjoyed the most favorable recoveries in EBITDA (Florida, Colorado, Texas, Illinois, New York) have benefited from continued lags in property tax payments. Conversely, hotels located in some locations where their respective EBITDAs still lag 2019, such as California, Massachusetts, Pennsylvania, and District of Columbia, have seen their property tax payments either increase or decline at a slower rate than the drop in profits. This suggests that there may be room for further reductions through tax appeals.

Trends by Property Class

We found that properties that rebounded fastest during the COVID years also saw reflexive changes in their respective tax burdens. Specifically, after seeing profits fall by over 90 percent between 2019 and 2020, in 2021 resort hotels realized EBITDA gains of almost tenfold that of 2020 and a further bump of over 50 percent in 2022. Property taxes initially dropped by 7.5 percent but saw modest gains of more than 3 percent in 2022. Through May 2023, CBRE has tracked resort profits sliding 8 percent year over year. Yet in the same period, property taxes increased by more than 3 percent.

In comparison, the full-service class of hotels, often found in urban settings, realized profit gains of more than 12 percent year-over-year through May 2023 but only realized tax increases of just under 3 percent. This appears to be more of a function of the timing of new assessments being released, as many cities do not send out assessment notices until midyear and tax bills are not due until sometime in the third or fourth quarter.

Expectations for 2023

Through May 2023, CBRE’s sample of 2,500 properties that provide monthly operating performance data have reported an increase in property tax payments of 1 percent compared to the first five months of 2022. While the 1 percent increase is minor, it does reverse the trend of two consecutive years of property tax declines in 2021 and 2022. Fortunately for hotel owners, EBITDA levels for this sample of properties are up 4.1 percent year-to-date through May 2023, perpetuating the recent national trend of property tax increases lagging changes in property values.

According to the PWC surveys, cap rates rose by 40 bps to 62 bps between Q1 2019 and Q3 2023. The RERC survey shows a much larger spread, of 60 bps to over 100 bps. Therefore, capping the same dollar plus 100 bps results in more than a 10 percent decline in value. Thus, even if the 2023 EBITDA is slightly ahead of 2019, it does correlate to an increase in overall property value. Further, it follows that property taxes should also exceed 2019 levels. As of July 2023, CBRE is projecting a decrease in operating performance in the latter part of the year as GDP growth decelerates and prior-year comparisons become less favorable. This could result in property tax moving in the opposite direction of profits. Therefore, hotel owners should closely monitor their published tax assessments in 2023 and 2024. The CBRE Hotels Property Tax team is available to help guide and serve our clients throughout the appeals process to ensure their assets are being assessed fairly and equitably.