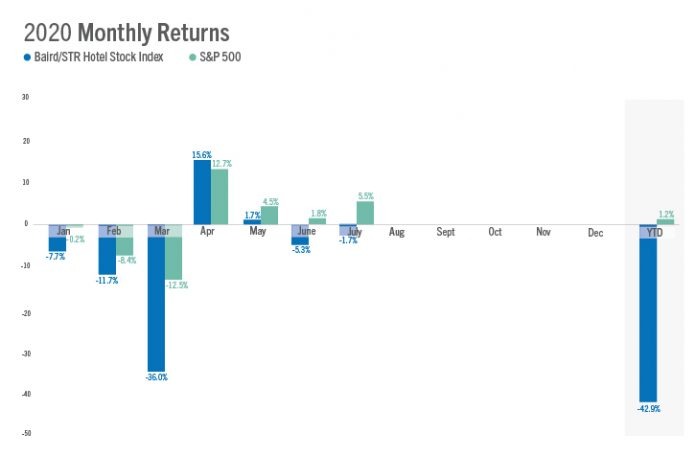

HENDERSONVILLE, Tenn., and MILWAUKEE — The Baird/STR Hotel Stock Index declined 1.7 percent in July to a level of 3,010. Year to date through the first seven months of 2020, the stock index was down 42.9 percent.

“Hotel stocks underperformed again in July as industry-wide occupancy growth continued to moderate on a weekly sequential basis,” said Michael Bellisario, senior hotel research analyst and director at Baird. “Investors remain focused on the impact of rising coronavirus case counts on broader travel trends, and prior optimism about the prospects for business travel to return in a meaningful way this fall has faded.”

“RevPAR declines over the last few weeks have not been as steep as prior weeks, but room demand, while increasing week over week, seems to have slowed,” said Amanda Hite, STR’s president. “With the vacation season still in full swing, beach- and mountain-type destinations are benefitting. Labor Day looms large, though, and it is doubtful that we will see a significant uptick in corporate demand to make up for the lack of consumers once schools start. There is basically no group demand to speak of, and we do not expect that to change for the remainder of 2020.”

July performance of the Baird/STR Hotel Stock Index fell behind the S&P 500 (up 5.5 percent) and the MSCI US REIT Index (up 3.9 percent).

The Hotel Brand sub-index increased 0.7 percent from June to 5,367, while the Hotel REIT sub-index was down 8.7 percent to 680.