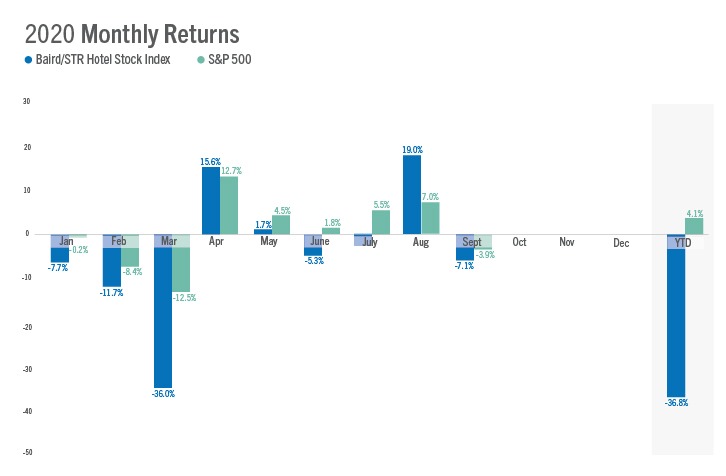

HENDERSONVILLE, Tennessee, and MILWAUKEE—The Baird/STR Hotel Stock Index dropped 7.1 percent in September 2020 to a level of 3,329. Year to date through the first nine months of 2020, the stock index was down 36.8 percent.

“Hotel stocks declined in September, which mirrored the broader market’s pullback,” said Michael Bellisario, senior hotel research analyst and director at Baird. “After significant absolute and relative gains in August, the September declines were modest in comparison. Investors have become more focused on a potentially slower economic growth outlook, an expected rise in coronavirus case counts as colder weather approaches, and the uncertainties associated with additional stimulus and the upcoming election, all of which negatively impacted hotel stocks’ performance during the month.”

“Much of the industry has reached the expected point where summer leisure demand has dried up and occupancy growth has stalled because of the absence of significant corporate travel and events,” said Amanda Hite, STR’s president. “There are pockets of the world, such as China, that are pushing closer to normal activity and levels of performance, but we don’t anticipate that trend to extend in the short term to regions like the United States and Europe.”

September 2020 performance of the Baird/STR Hotel Stock Index fell behind both the S&P 500 (down 3.9 percent) and the MSCI US REIT Index (down 3.7 percent).

The Hotel Brand sub-index declined 8.1 percent from August to 5,969, while the Hotel REIT sub-index fell 3.3 percent to 739.